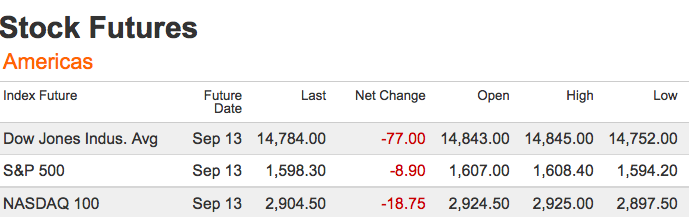

We interrupt this vacation to bring you the latest silliness form over there. This morning, it is the resignation of two Portuguese cabinet ministers that is blamed for leading European bonds and stocks to heavy declines. US futures slid following losses across the pond that are substantial.

The main Portuguese slid 5%, while the nation’s 10-year bond yield popped over 8% (it was last there back in November). Most of Euopean bourses slid 1% or so.

While some are blaming Portugal, the latest out of Egypt is just as (if not more) likely a source. The coup announced by the Egyptian Military to overthrow the Muslim Brotherhood has sent Crude oil above $100 a barrel. This was a genuine surprise to many Middle East observers outside of Egypt, and is just as good an excuse as any for the global market unrest. (Or not. I don’t know.)

Around the world, there has been modest pressure on equities. According to Bloomberg, MSCI Emerging Markets Index fell 2%, while the Hang Seng China Enterprises Index (Hong Kong listings) dropped 3.3%. Turkey, with its own unrest roiling its markets, also dropped 3.2% and Two-year yields jumped 22 basis points to 7.56% on higher than expected inflation.

Headlines:

• Portugal’s Coalition Splinters on Austerity Fatigue (Bloomberg)

• European Markets Slump on Political Crises (NYT)

• Egypt’s Leader Vows to Stay (WSJ)

• Morsi and Egyptian Generals Edge Closer to Conflict (NYT)

What's been said:

Discussions found on the web: