Kotok via David Wilson:

Municipal bonds are an “outrageous bargain” in the wake of Detroit’s bankruptcy filing, according to David R. Kotok, Cumberland Advisors Inc.’s chairman and chief investment officer.

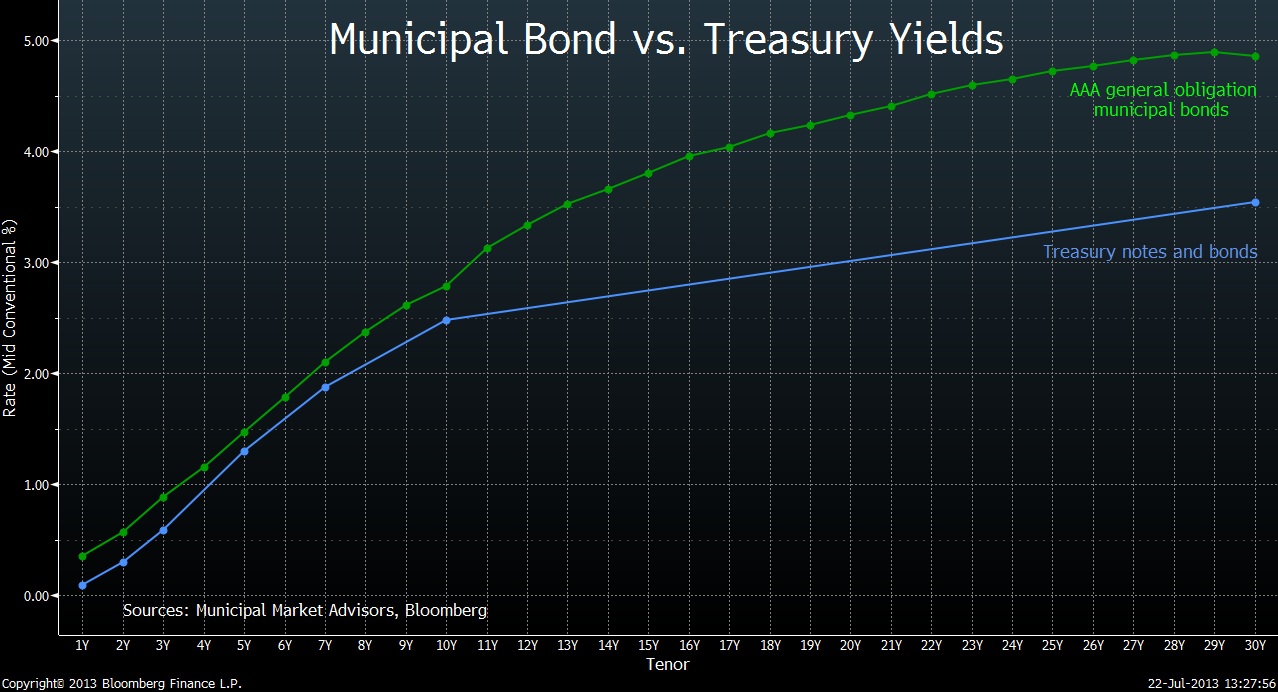

As the CHART OF THE DAY shows, the highest-rated notes and bonds of state and local governments yield more than Treasuries of similar maturity for 1 year through 30 years without having to adjust for tax benefits. The data was compiled by Municipal Market Advisors, an independent research firm, and Bloomberg.

“The present pricing of tax-free bonds makes sense only if we happen to think the income-tax code of the U.S. is going to be repealed,” Kotok wrote yesterday in a commentary. “We are seizing on this bargain provided to us by market dysfunction.”Yields on AAA rated general obligation bonds, backed by the seller’s credit and taxing power as opposed to a specific source of revenue, appear in the chart. They are typically lower than Treasury yields because their interest is exempted from U.S. income taxes, unlike payments on federal debt.

Top-rated 10-year debt yielded 31 basis points more than comparable Treasuries at the end of last week. Since 2001, the yield has been 30 basis points less on average. Each basis point amounts to 0.01 percentage point.

Municipal borrowers that have the highest ratings and best track records are almost as creditworthy as the Treasury, wrote Kotok, based in Sarasota, Florida. “History is 100 percent on the bond buyer’s side when it comes to this debate,” he wrote.

Detroit, which filed for Chapter 9 bankruptcy protection last week, lost investment-grade ratings on its debt in 2009.

Source:

David Wilson

Bloomberg, July 23, 2013

What's been said:

Discussions found on the web: