My fishing pal and hedge fund buddy Scott forwards along an email from an anonymous analyst in Asia, who is somewhat perplexed by the massive “rent to flip” private equity investment in US distressed (or not so distressed) homes:

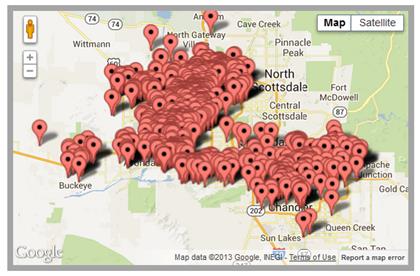

Take a look at the number of houses for rent in Phoenix. This is from Silver Bay, one of many Wall Street REO to rental companies, not to mention all the private big and small investors. The snap shot above was taken today off their website.

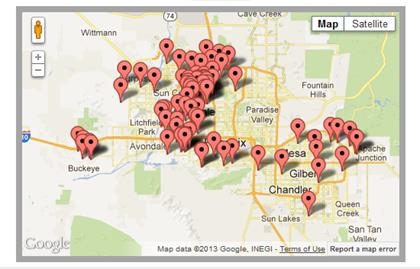

The following is the snap shot I took on March 18, almost exactly 4 months ago.

How the hell can they be making money when there are so many empty houses cooking in the desert sun? How can they possibly generate those double digit cap rates?

Sooner or later, these Wall Street OPM is going to lose interest. I like to see how Bernanke is going to carry the pump all by himself to inflate this real estate recovery story.

Source: Silver Bay Management

What's been said:

Discussions found on the web: