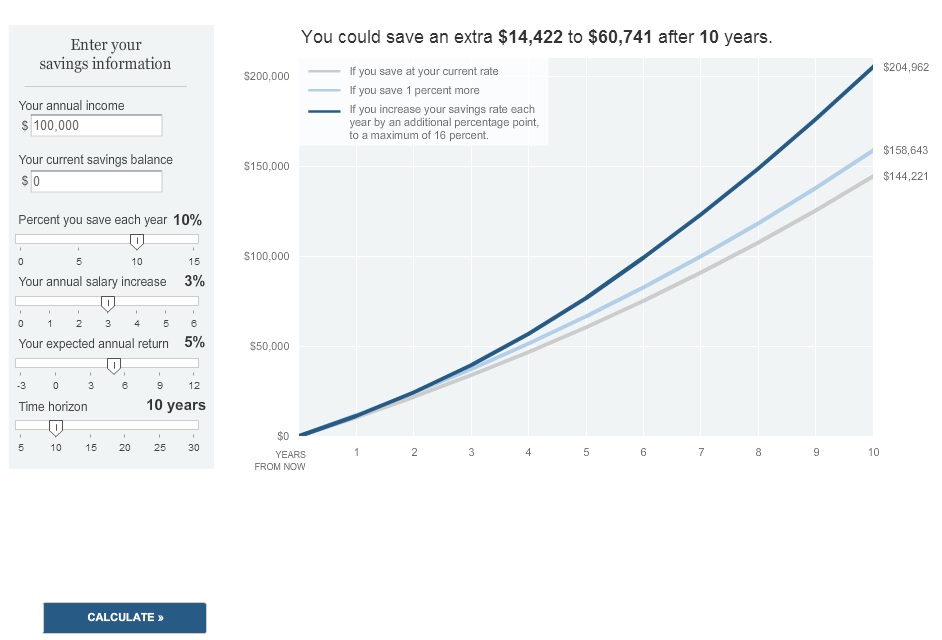

Interesting example of what a small bump up does to your long term savings:

Click for interactive calculator:

Source: NYT

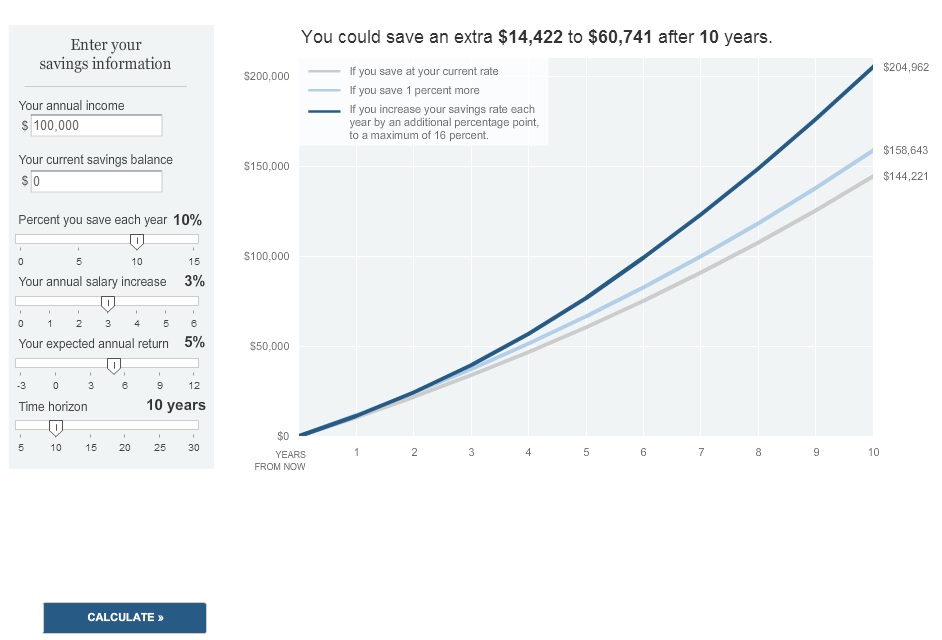

Interesting example of what a small bump up does to your long term savings:

Click for interactive calculator:

Source: NYT

Get subscriber-only insights and news delivered by Barry every two weeks.

What's been said:

Discussions found on the web: