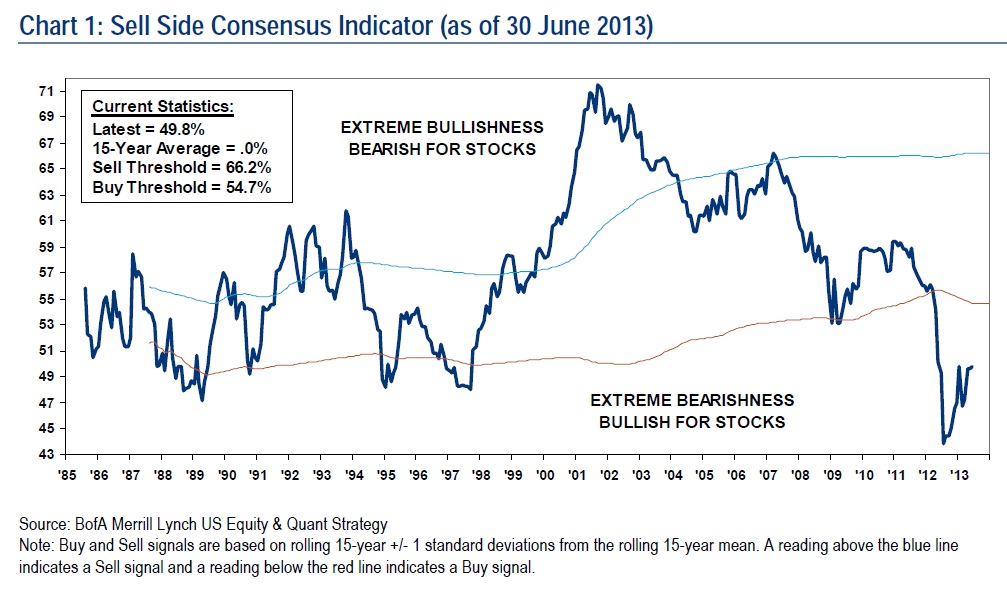

Merrill Lynch continues to point out that the Street remains unenthusiastic about stocks:

Sentiment ticks up to highest in 13mos, but still far from bullish

The Sell Side Indicator — our measure of Wall Street’s bullishness on stocks — ticked up just slightly in June to 49.8 from 49.6. The indicator has improved in eight of the last eleven months after hitting an all-time low of 43.9 last July, and is now at its highest level since May 2012, when it first flashed a “Buy” signal. The indicator still remains firmly in “Buy” territory, however, as Wall Street’s bearishness on equities remains at extreme levels relative to history. Given the contrarian nature of this indicator, we remain encouraged by Wall Street’s ongoing lack of optimism and the fact that strategists are recommending that investors significantly underweight equities at 49.8% vs. a traditional long-term average benchmark weighting of 60-65%. Even though the S&P 500 climbed 20% from when sentiment bottomed to its all-time-high in May, history suggests that strong equity returns can last for years after the indicator troughs.Indicator’s expected 12-month total return is +24%

With the S&P 500’s indicated dividend yield above 2%, that implies a 12-month price return of 22% and a 12-month value of 1955. Although this is not our S&P 500 target, this model is an input into our target, which incorporates valuation, sentiment and technicals. Historically, when our indicator has been below 50, total returns over the subsequent 12 months have been positive 100% of the time, with median 12-month returns of +30%. Past performance is not an indication of future results.A reliable contrarian indicator

The Sell Side Indicator is based on the average recommended equity allocation of Wall Street strategists as of the last business day of each month. We have found that Wall Street’s consensus equity allocation has historically been a reliable contrary indicator. In other words, it has historically been a bullish signal when Wall Street was extremely bearish, and vice versa. See our December report for more details on the Sell Side Indicator.

Very interesting stuff . . .

Source:

Sell Side Indicator: Wall Street Still Lukewarm on Equities

Savita Subramanian

Merrill Lynch Research, 01 July 2013

What's been said:

Discussions found on the web: