My afternoon walk about reads:

• Is the interest rate on reserves holding the economy back? (Noahpinion)

• The San Francisco Rent Explosion (Priceonomics) see also Sublets Lure Manhattan Start-Ups (NYT)

• Three Thought-Provoking Central Banking Reads (Quantitative Ease)

• Steve Cohen’s Overflowing Email Inbox (Moneybeat)

• The Complete Failure Of Austerity, In 1 Chart (HuffPo)

• Some Thoughts on Recent Chinese GDP Growth (Econbrowser)

• Fed Criticized on Oversight of Bank-Owned Commodity Units (Bloomberg)

• An Analysis Of Long-Term Unemployment, With Some Help From Dilbert… (Economists Do It with Models) see also The New Economics of Part-Time Employment, Continued (Economix)

• WTF?! Greenwich Joins New York at Top of U.S. Sushinomic Index (Bloomberg)

• NBC/WSJ poll: Faith in DC hits a low; 83% disapprove of Congress (First Read)

What are you reading?

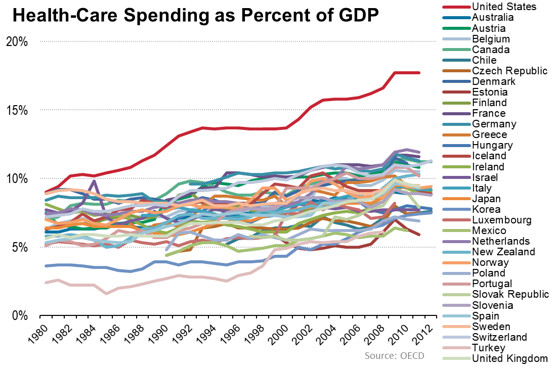

U.S. Health Spending: One of These Things Not Like Others

Source: Real Time Economics

What's been said:

Discussions found on the web: