My longer form weekend material, expertly curated for your reading pleasure:

• The best investment advice you’ll never get (Modern Luxury)

• Shameful: How the Pentagon’s payroll quagmire traps soldiers (Reuters)

• The Water-Park Scandal and Two Americas in the Raw: Are We a Nation of Line-Cutters, or Are We the Line? (Esquire)

• Risk Parity edition (Abnormal Returns)

• In America’s Pastime, Baseball Players Pass A Lot of Time (WSJ) but see In Defense of Baseball’s Lazy Pace (WSJ)

• The Road To Resilience: How Unscientific Innovation Saved Marlin Steel (Fast Company)

• How the media outrageously blew the IRS scandal: A full accounting (Salon)

• Disruptions: How Driverless Cars Could Reshape Cities (Bits) see also The wastefulness of automation (Pieria)

• Internet trolls: What to do about the scourge of the Web? (CNN)

• How wonder works (Aeon)

Whats up this weekend?

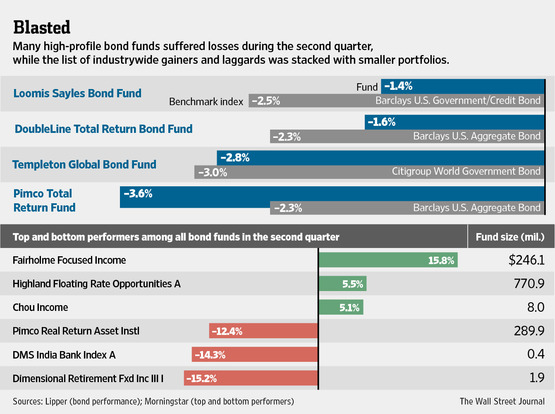

Bruising Quarter for Bond Fund Managers

Source: WSJ

What's been said:

Discussions found on the web: