Here are my longer form journalism for your weekend reading pleasure:

• Has Carl June Found a Key to Fighting Cancer? (Philadelphia Magazine)

• The Blip: What if everything we’ve come to think of as American is predicated on a freak coincidence of economic history? (NY Mag)

• Understanding Google (Stratechery)

• Unhappy Truckers and Other Algorithmic Problems (Nautilus)

• The Last Days of Big Law You can’t imagine the terror when the money dries up (New Republic)

• Intense commitment for religious, political or philosophical ideas create Ideological Bias (Seeking Wisdom)

• Have You Heard the One About President Joe Biden? (GQ) see also Why the G.O.P Needs to Lose for a Third Time (Rational Irrationality)

• The Cheat Code to Life (Wired)

• Twelve Absent Men: Rebuilding the American Jury (Boston Review)

• ‘Community’s’ Dan Harmon Reveals the Wild Story Behind His Firing and Rehiring (Hollywood Reporter)

What are you doing this weekend?

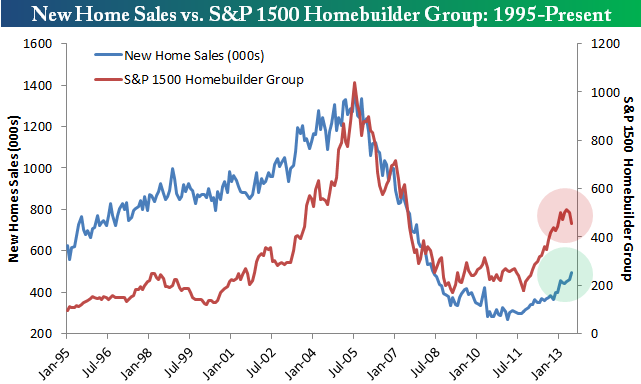

New Home Sales Hit Five-Year High as Homebuilders Struggle

Source: Bespoke

What's been said:

Discussions found on the web: