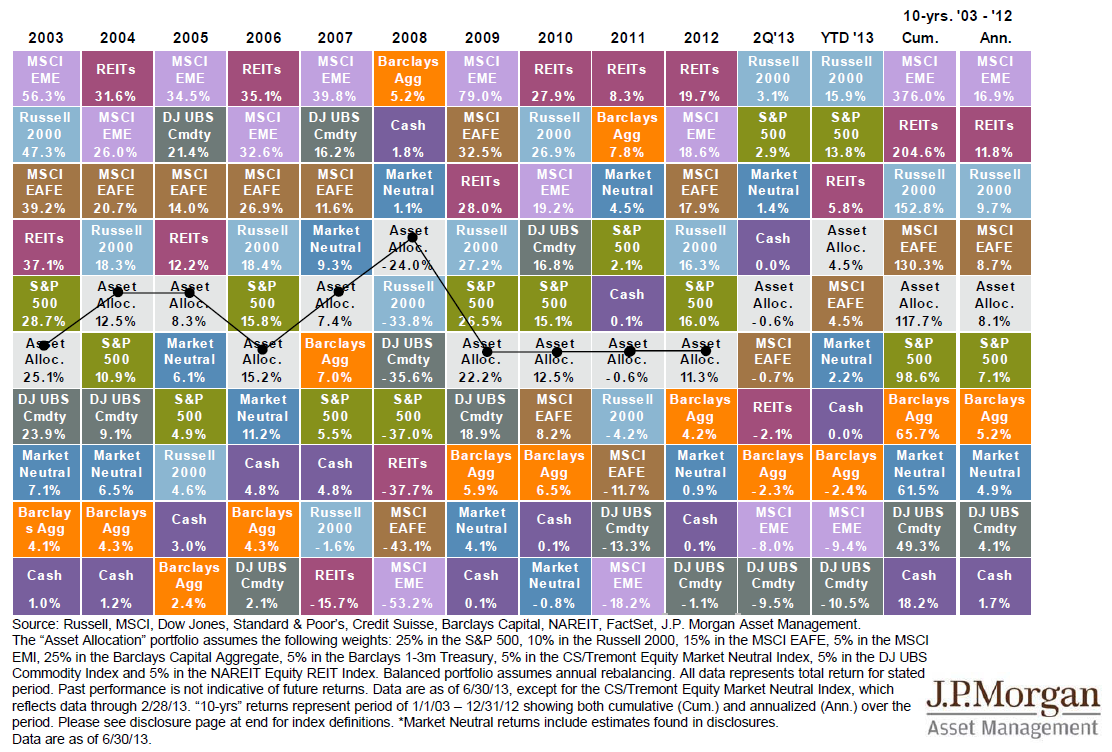

Click for ginormous table

Source: J.P. Morgan

I really like the above table — its a terribly instructive reminder as to how little we know about the future. Look how often the sector you least expected to be the winner ended up on top.

Its also instructive to see what ends up near the top of the list on a regular basis.

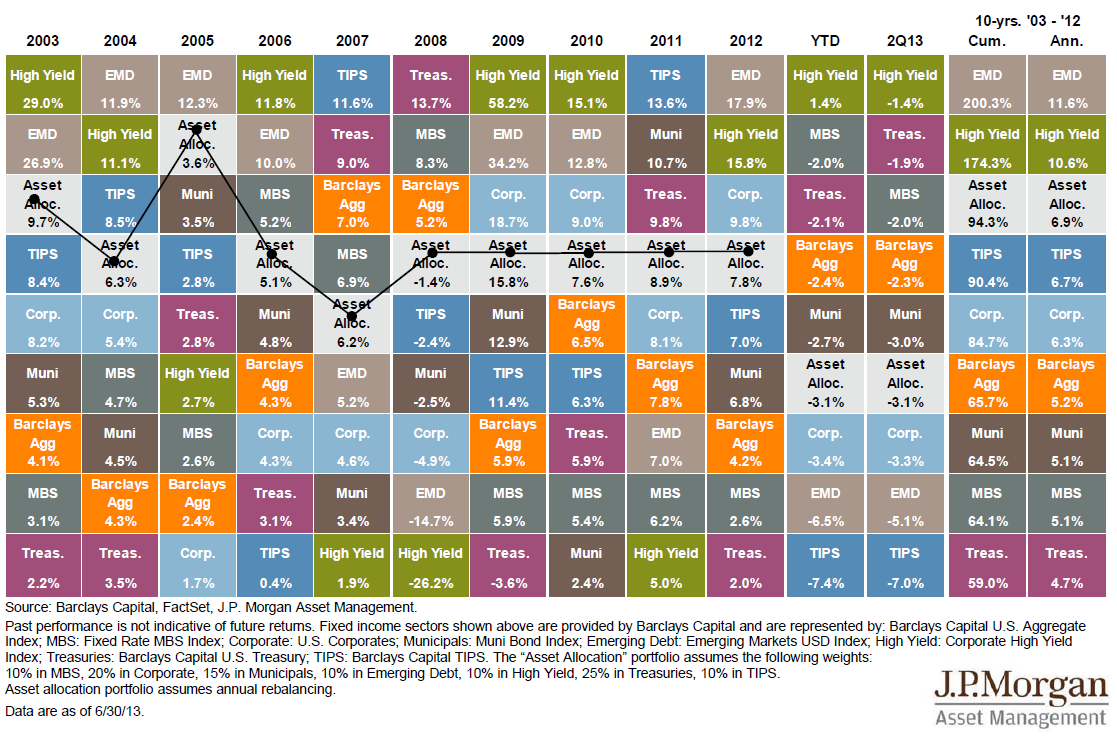

The breakdown of Fixed Income annual winners is after the jump.

Source: J.P. Morgan

What's been said:

Discussions found on the web: