Click to enlarge

Source: Merrill Lynch

I meant to get to this last week but travel (a/k/a Nasdaq Freeze) got in the way

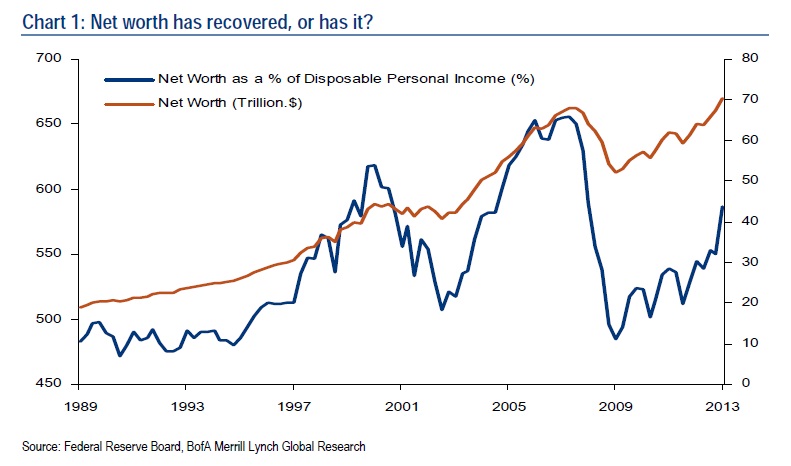

“After collapsing in 2008-10, net worth is booming again and has now surpassed the 2007 peak. A generous take on this is that the dollar value of wealth has now fully recovered; a more realistic interpretation is that wealth as a share of income has been flat over the last 14 years. During this period, boomers moved out of their 40s and into their 50s. Saving and wealth gains should have been unusually high as they set up for retirement; instead they are running in place.”

Two things to note about this: This is national net wealth, not per capita. So it does not reflect population growth, inflation, etc.

Second, it does now show where we would have been had the crisis never occurred. Its 5 years later, and getting back to breakeven is not my favorite metric to show the impact of the crisis . . .

Source:

Ethan S. Harris, Alexander Lin, Joshua Dennerlein, Michael S. Hanson, Michelle Meyer

Bank of America Merrill Lynch, August 20, 2013

What's been said:

Discussions found on the web: