My afternoon train reading:

• Maximizing shareholder value: The goal that changed corporate America (Washington Post)

• Economy recovering, but pay stuck in the doldrums (SFGate) see also How Wide Is Your Wage Gap? New Rule Would Reveal CEO Pay vs. Employee Pay (Forbes)

• Study: 0.7% of all mobile malware affects iOS, Android accounts for 79% (Tuaw)

• China’s American Bailout? (Project Syndicate) see also China Construction Bank Sees Bad-Debt Risk (WSJ)

• How to Charge $546 for Six Liters of Saltwater (NYT)

• Microsoft’s Ballmer on his biggest regret, the next CEO and more (ZDNet) see also Ballmer Departure From Microsoft Was More Sudden Than Portrayed by the Company (All Things D)

• A Quest for Even Safer Drinking Water (NYT)

• Summer 2013: Who Really Owns the U.S. National Debt? (Political Calculations)

• The Dirty Talk Of The Town: Profanity At “The New Yorker” (The Awl) see also The New York Times (quietly) drops the F-bomb (Salon)

• U.S. Economy Grinds To Halt As Nation Realizes Money Just A Symbolic, Mutually Shared Illusion (The Onion)

What are you reading?

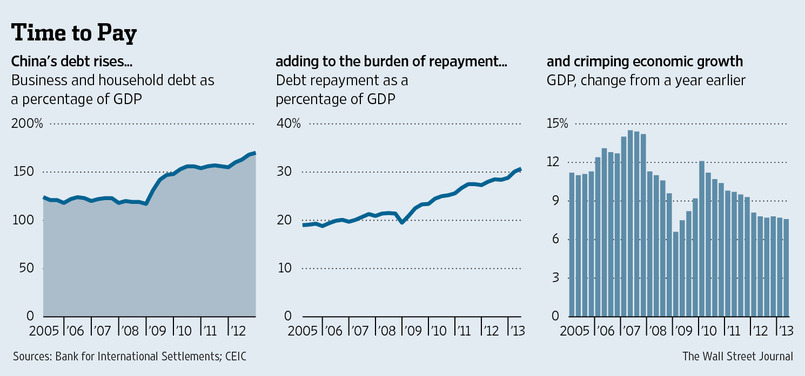

Debt Drags on China’s Growth

Source: WSJ

What's been said:

Discussions found on the web: