My morning reading:

• Triskaidekaphobia (fear of Friday the 13th) and the stock market. (Brain M. Lucey) see also This market keeps defying the bears (msn money)

• Foreclosure crisis is drawing to a close (CNNMoney)

• Hedge Funds Are Among the Winners of the Lehman Spoils (WSJ) see also We’ve let a good financial crisis go to waste since Lehman Brothers collapsed (Telegraph)

• How We Learned Not to Guzzle (NYT)

• Larry Summers’ Citigroup Problem (MoJo) see also Secret Campaign for Chairman of the Federal Reserve (Daily Beast)

• Today’s WTF?? headline: Hank Paulson, hero? (Reuters)

• No, Economics Is Good for Lots of Things (Noahpinion) see also The No Mo or Mighty Mo Forecast and Harry Truman’s Quest for a One-Armed Economist (Spellman Report)

• Just How Long Can People Live? (Slate)

• Why the iPhone’s fingerprint sensor is better than the ones on older laptops (Cite World) see also Machines Made to Know You, by Touch, Voice, Even by Heart (Bits)

• The Many Mysteries of Air Travel (Pogue’s Posts)

What are you reading?

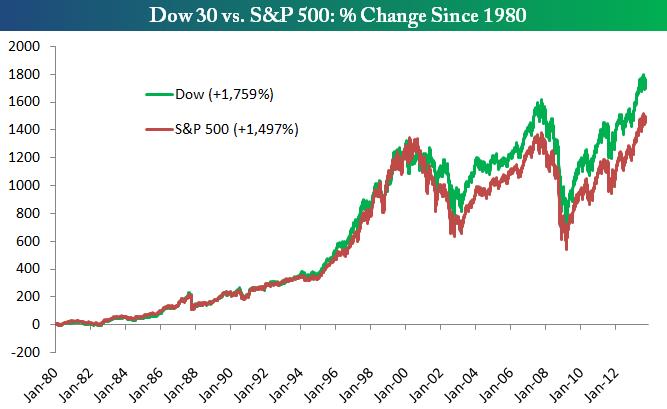

Dow vs. S&P 500

Source: Bespoke

What's been said:

Discussions found on the web: