My morning reading:

• How to Fire Your Financial Adviser (WSJ)

• The Past 5 Years Explained in 73 Headlines (Motley Fool)

• Jony Ive: The man behind Apple’s magic curtain (USA Today) see also Apple Chiefs Discuss Strategy, Market Share—and the New iPhones (Businessweek)

• Boat Sales Buoyed as Americans Downsize Fleets (Bloomberg)

• Interconnectedness and Contagion (Social Science Research Network) see also ‘Too big to fail’ is still a threat to the financial system (FT.com)

• The Return of the Decade of the Brain (Esquire)

• AllThingsD parting ways with Dow Jones (Fortune) see also AllThingsD founders are in talks to value their new venture at up to $40 million (Quartz)

• How to Haggle for Art (WSJ)

• Once an $18,000 Home on a Decaying Street, Now a $5 Million Gem (NYT) see also U.S. Homebuying Math Bolstered by Bernanke’s Surprise (Bloomberg)

• Comedians as Prophets (Esquire)

What are you reading?

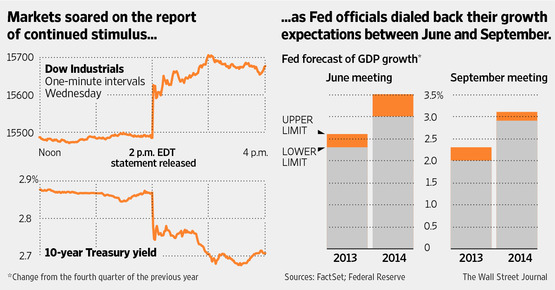

Stock Investors Are Left Wondering When on Fed’s Taper

Source: WSJ

What's been said:

Discussions found on the web: