My afternoon train reading:

• “It’s nice when you can control your own destiny” (The Reformed Broker)

• Further Ossification of the Zero Lower Bound? (Macro and Other Market Musings) see also Has the Fed Been Fooled by Phony Jobs Numbers? (The Ticker)

• After the Meltdown (Center for Public Integrity)

• This Selfish Ayn Rand Business Philosophy Is Ruining The US Economy (Business Insider)

• Asset Allocation for Muppets with a 401(k) (25iq) see also 401(k)s are replacing pensions. That’s making inequality worse. (Wonkblog)

• Apple Market Share: Facts and Psychology (Monday Note)

• Banks find appalling new way to cheat homeowners (Salon) see also Is JP Morgan Out of Control? (The Reformed Broker)

• The Bullshit Police (The Daily Beast)

• New questions about the Financial Crisis Inquiry Commission (Columbia Journalism Review)

•’Popular Science’ Shuts Comments, Citing Internet ‘Trolls’ (NPR)

What are you reading?

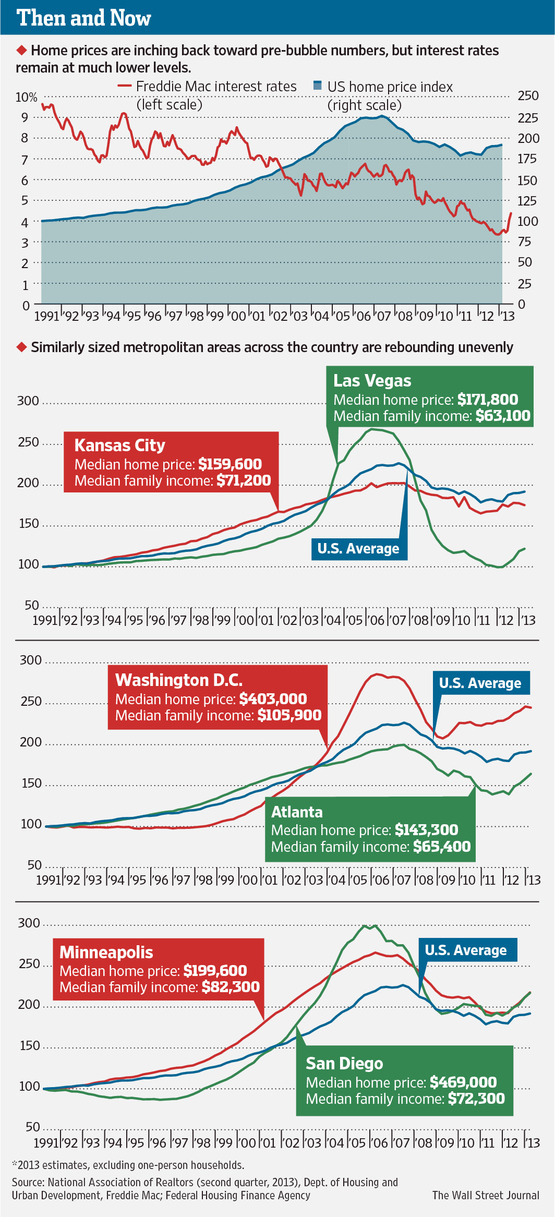

Housing Market’s Flashing Yellow Lights

Source: WSJ

What's been said:

Discussions found on the web: