My morning reading:

• Financial Crisis: Lessons of the Rescue, A Drama in Five Acts (WSJ) see also 2008 financial crisis: Could it happen again? (USA Today)

• Secret Swiss Accounts Said No Longer Safe for Tax Dodging (Bloomberg)

• When Half-Right Forecasts are Deadly (The Reformed Broker)

• Crazy Talk: The Death of Buy & Hold (Morningstar)

• Trading Your 401(k) Account: How Bright Can It Be? (Moneybeat)

• Investors Bet On Battered Markets (WSJ)

• Low Interest Rates, Savers, and the Recovery (Noahpinion) see also America’s huge mistake on monetary policy: How negative interest rates could have stopped the Great Recession in its tracks (Quartz)

• Thinking About iPhone Pricing (stratēchery)

• Chinese Zombies Emerging After Years of Solar Subsidies (Bloomberg)

• Why Are You Not Dead Yet? (Slate)

What are you reading?

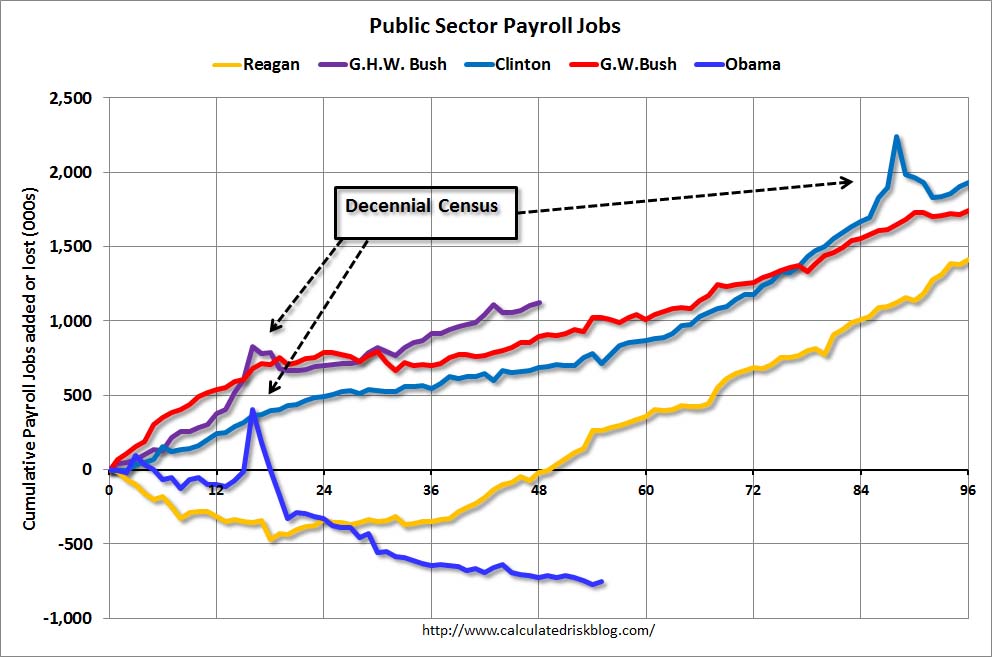

Public and Private Sector Payroll Jobs: Reagan, Bush, Clinton, Bush, Obama

Source: Calculated Risk

What's been said:

Discussions found on the web: