My morning reading:

• Forget stock picking, stick with the indexes (MarketWatch)

• ‘Sharing economy’ is here to stay, so get used to it (Los Angeles Times)

• How Many ‘Greater Fools’ Does It Take to Make a Bubble? (Moneybeat) see also Housing Market Is Heating Up, if Not Yet Bubbling (Dealbook)

• A Synopsis of Fedspeak (Tim Duy’s Fed Watch)

• The JP Morgan apologists of CNBC (Reuters) see also Why Judges Are Scowling at Banks (NYT)

• Fiscal debates: Troubled waters ahead or perfect calm? (Vanguard)

• How to probe public attitudes? (Understanding Society)

• The Genius Of Twitter: A Paean (Tech Crunch)

• Obsoletive (stratēchery)

• New York in Black and White (Wired New York)

What are you reading?

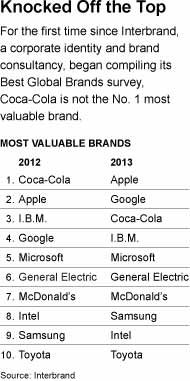

Apple Passes Coca-Cola as Most Valuable Brand

Source: NYT

What's been said:

Discussions found on the web: