My afternoon train reading:

• The Unofficial Dividend.com Guide To Being An Investor (Dividend.com)

• 10 Terms Investment Pros Use to Raise Money (The Reformed Broker)

• The Shocking Cost to Taxpayers of a Shutdown (Fiscal Times)

• 10 surprising economic trends that rule the world (Quartz)

• Fed Too Familiar With Lost Workers Seeks New Guideposts: Economy (Bloomberg) see also Janet Yellen record gives pointer to Fed policy if Obama picks her as chair (FT.com)

• How Tighter Mortgage Standards Are Holding Back the Recovery (WSJ)

• Invest in whatever Wall Street hates (MarketWatch)

• Who Should Invest in Startups? (Priceonomics)

• How I botched it on CNBC (Salon)

• Survival After Cancer Diagnosis Strongly Associated With Governments Spending On Health Care (Science Daily)

What are you reading?

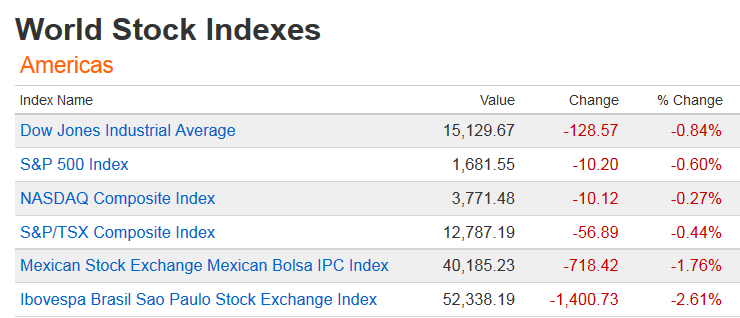

Source: Bloomberg

What's been said:

Discussions found on the web: