My Sunday morning reads:

• The Global Quest to Save Retirement (Bloomberg) but see Retirees Are Optimistic (or Delusional) About Leaving Inheritances (Bloomberg)

• New Indicator Suggests the Market Is Getting Riskier (Marketwatch)

• Ben Bernanke Continues To Crush It As Most Hedge Funds Underperform: Complete Hedge Fund Performance Update (Zero Hedge)

• Drivers of financial boom and bust may be all in the mind, study finds (EurekAlert) see also “New Shit Has Come to Light”: Information Seeking Behavior in The Big Lebowski (Wiley Online Library)

• With a Tweet, Twitter Starts a Debate About IPOs (NYT)

• The only uncertainty is why some cannot see facts. (Antonio Fatas on the Global Economy)

• Four Lost Decades: Why American Politics is All Messed Up (Rational Irrationality)

• The Market Failure of First Dates (Priceonomics)

• The $550 iPhone 5C Makes Perfect Sense (stratēchery) see also Retail Therapy: Inside the Apple Store (McSweeney’s)

• 21 Ways Supermarkets Control Your Mind (BuzzFeed)

What’s for brunch?

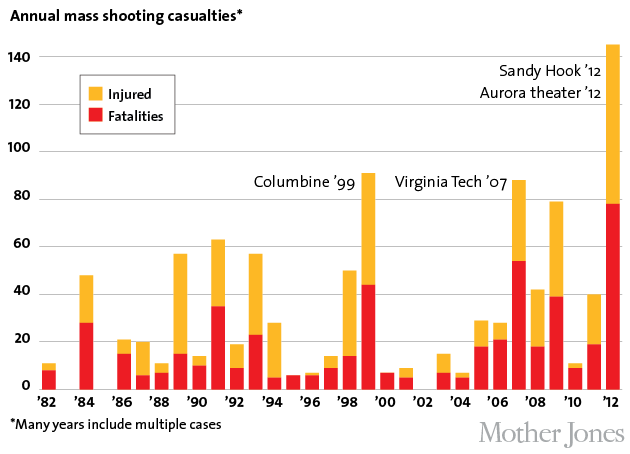

Annual Mass Shooting Casualties

Source: I Love Charts

What's been said:

Discussions found on the web: