My morning reading:

• Bernanke Saves Companies $700 Billion as Verizon Leads Sales (Bloomberg) see also I can haz no capex (FT Alphaville)

• Higher-Yielding Stocks Seen as Benefiting Most From Fed Status Quo (WSJ)

• Why didn’t the Fed taper? Because Congress is horrible. (Wonkblog) see also No Taper – Yet (Tim Duy’s Fed Watch)

• What ‘The Big Lebowski’ tells us about the debt ceiling (The Fix)

• Wolf: We still live in Lehman’s shadow (FT.com)

• The Financial Crisis Through the Eyes of the Millennial Generation (Elliot S. Weissbluth)

• Twitter’s IPO will not be done in secret (Fortune) see also Twitter’s IPO Will Reveal How Many Fake Or Inactive Users It Has — And It May Not Be Pretty (Business Insider)

• Excel paintings (Flowing Data)

• Make Sure You Know Who Will Inherit Your Twitter Account (WSJ)

• iOS 7, thoroughly reviewed (ArsTechnica) see also The best hidden features in iOS 7 (The Verge)

What are you reading?

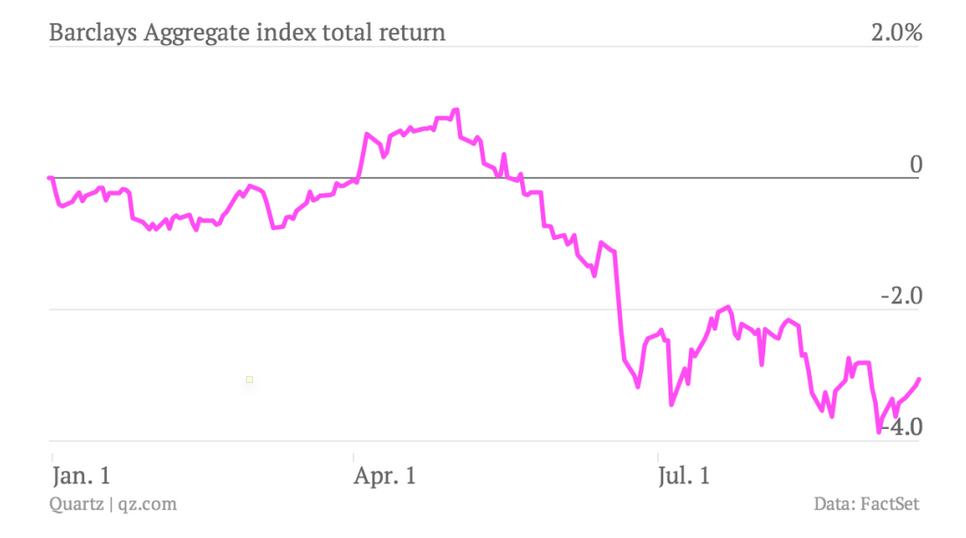

The bond market is on track for its worst year in four decades

Source: Quartz

What's been said:

Discussions found on the web: