My afternoon train reading:

• Why Investment Performance Is a Distraction (Think Advisor)

• What does your net worth really mean? (Christian Science Monitor)

• Quants-R-Us? Algorithmic Trading Trickles Down To Individual Investors. (Forbes)

• 212 Years of Price Momentum (The World’s Longest Backtest: 1801-2012) (SSRN)

• Using Google to Predict Recessions? (Canada Real Time)

• China’s banks are hogging the country’s market earnings, and that spells trouble (Quartz)

• Rage about anonymous online comments is building: change is coming (George Brock)

• R.I.P. Windows (Slate) see also Where Nokia Went Wrong (New Yorker)

• Make Time for the Work That Matters (Harvard Business Review)

• 27 Things Media People Like (BuzzFeed)

What are you reading?

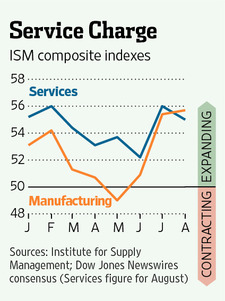

U.S. Can Catch Emerging Nations’ Malaise

Source: WSJ

What's been said:

Discussions found on the web: