My afternoon train reading:

• Fed recoils from 1937 tightening error as jobs evaporate (Telegraph) see also What are the Risks of Quantitative Easing, Really? (Brad DeLong)

• “Bernanke is nothing if not a patient lover” (TRB)

• Breathing Room for Emerging Markets Watching Money Flee (NYT) see also Fed Leaves Hedge Fund Bears Waiting on Emerging-Markets Bet (Bloomberg)

• Smart Beta and the Pendulum of Mispricing (Research Affiliates)

• The Doom In Investing With Doomsayer Peter Schiff (YCharts) see also Peter Schiff Was Wrong (Mish)

• What You Need to Know Before Buying a House (WSJ)

• Next Reform Target: The Banker’s Brain (American Banker)

• Baum: ’Party of No’ Should Focus on ’Getting to Yes’ (Bloomberg)

• Smartphone Cameras at 41 Megapixels Pressure Canon, Nikon (Bloomberg) see also Everything You Need to Know About the iPhone 5C and 5S Reviews in One Table (Atlantic Wire)

• 8 Creativity Lessons from a Pixar Animator (Zen Habits)

What are you reading?

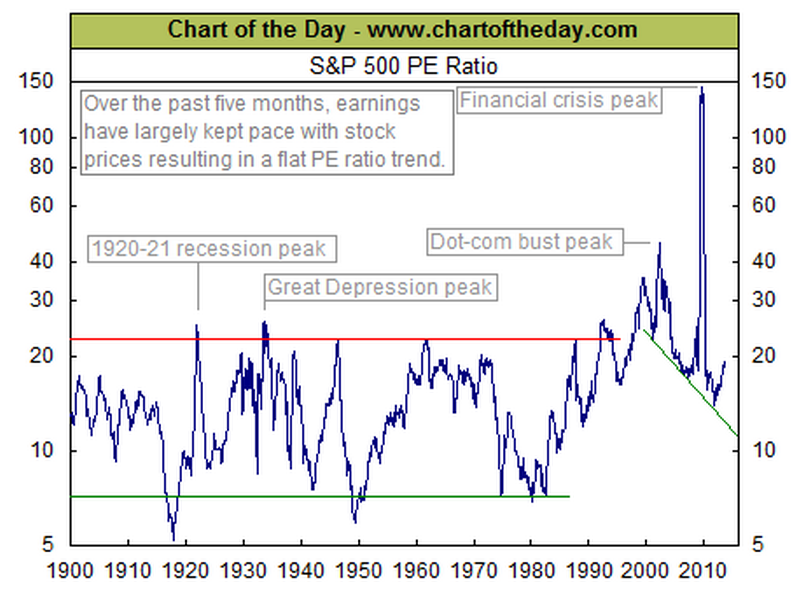

S&P 500 PE Ratio

Source: Chart of the Day

What's been said:

Discussions found on the web: