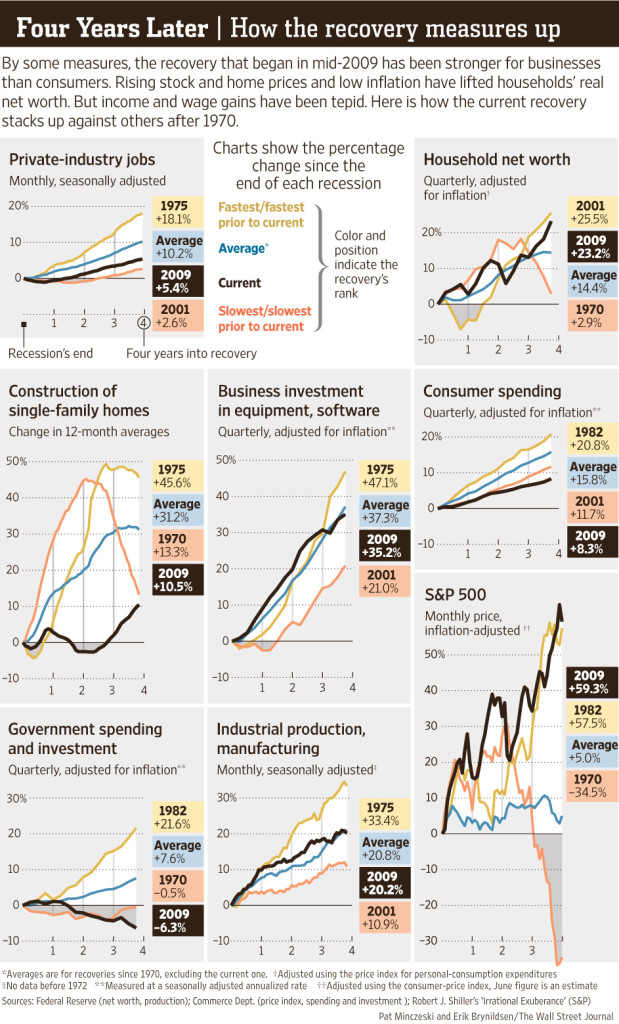

After four bumpy years, the U.S. recovery finally appears to be on a smoother road. Many economists now predict 2014 will be the best year for growth since 2005, while joblessness is expected to click below 7% next year for the first time since 2008. Houses are selling again, the energy sector is booming and jobs, while not plentiful, are being created at a steady pace.

Pat Minczeski and Erik Brynildsen

Source: The Wall Street Journal

What's been said:

Discussions found on the web: