Click to enlarge

Source: Institute for New Economic Thinking

NYU prof Robert Engle, who long-time blog readers may recall from this post a ways back, won the Nobel prize for his work on Volatility.

He has developed new ways to measure “Systemic risk” from his perch at the Volatility Institute at NYU:

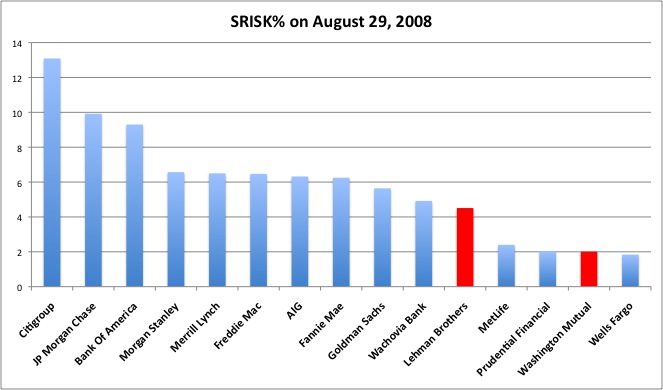

“We estimate the amount of capital that a financial institution would have to raise in order to continue to function normally if we have another financial crisis like the one in 2008. This is interpreted as a capital cushion to protect against a decline of 40% in the broad equity market over the six months after this occurs . . .

We call this measure SRISK. We compute it weekly and post it on the website systemicrisk. The estimation uses equity prices with methods that are extensions of the volatility models that formed the basis for my Nobel Prize. SRISK combines information on size, leverage, and risk to indicate how serious a default would be.

As the chart above shows, Lehman was not the only one who had engaged in too much risk taking. Indeed, they were not even the worst offender. And as the table below shows, JP Morgan now represents the greatest risk to the financial system.

Source: NYU VLAB

When we talk about risk in the system, this is what we are referring to.

What's been said:

Discussions found on the web: