My afternoon train reading:

• Is It Sell Rosh, Buy Yom? Or Vice Versa? (Total Return) see also Who Cares About Syria? The Fed Is Buying Fewer Bonds! (Moneybeat)

• The Limits of Fundamental Analysis (Crossing Wall Street)

• Bank Leverage Is the Defining Debate of Our Time (Bloomberg) see also The Failure of Free-Market Finance (Project Syndicate)

• U.S. Importing Much Less Oil, but Still Spending a Lot on It (Real Time Economics)

• No Bounce for Europe in Rebound by Germany (NYT)

• Pimco sitcom: dreamer Gross vs. worrywart El-Erian (MarketWatch) see also Gross, Gundlach Hit by Outflows in August Amid Jitters Over Fed (Moneybeat)

• Business Losing Clout in a G.O.P. Moving Right (NYT)

• Thorny Side Effects in Silicon Valley Tactic to Keep Control (DealBook)

• Local shops fear Amazon’s expansion (CNNMoney) see also Introducing the All-New Kindle Paperwhite—The 6th Generation of Kindle (Amazon)

• What we don’t know about the $1.2 trillion student loan problem (Reuters)

What are you reading?

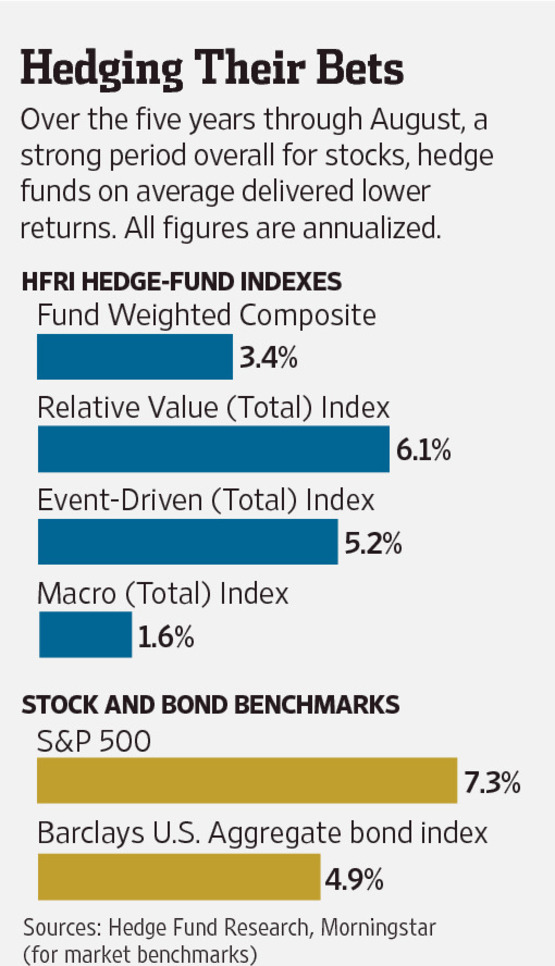

What Is a Hedge Fund, Anyway?

Source: WSJ

What's been said:

Discussions found on the web: