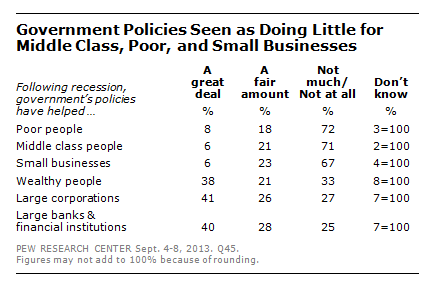

Nearly seven-in-ten Americans say large banks and financial institutions have benefited the most from post-recession government policies (apparently, three-in-ten Americans don’t have a clue).

Pew reports that sizable majorities say the beneficiaries of government policies are large banks and financial institutions, large corporations and wealthy people. The beneficiaries according to the public: 69% say large banks and financial institutions gained the most; 67% noted large corporations, and 59% said wealthy people.

and this:

Source: PEW

People have finally come around to realizing what happened and who made out like bandits. I guess better late than never.

Sources:

Majority of Americans say banks, large corporations benefitted most from U.S. economic policies

By Bruce Drake

Pew Research September 20, 2013

http://www.pewresearch.org/fact-tank/2013/09/20/majority-of-americans-say-banks-large-corporations-benefitted-most-from-u-s-economic-policies/

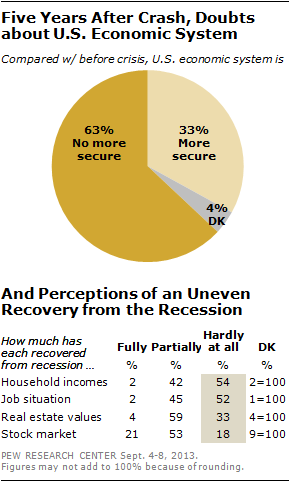

Five Years after Market Crash, U.S. Economy Seen as ‘No More Secure’

PEW September 12, 2013,

http://www.people-press.org/2013/09/12/five-years-after-market-crash-u-s-economy-seen-as-no-more-secure/#winners-losers

What's been said:

Discussions found on the web: