My morning reading:

• In Latest IPOs, Profits Aren’t the Point (WSJ)

• Living in a low return world (Abnormal Returns)

•Today’s wacky Bloomberg Headlines:

…..-China Export Gains Understated on Fake-Data Distortions (Bloomberg)

…..-JPMorgan Clients Roll Bonds as Schwab Options Hedge Default (Bloomberg)

• Nate Silver: The Six Big Takeaways From the Government Shutdown (Grantland)

• Squandering America’s Debt Advantage (WSJ) see also Why the level of government debt may not matter (FT Alphaville)

• The Anti-Yellen Campaigning Has Begun (Slate)

• Buried in Fine Print: $57B of FHA Loans Big Banks May Have to Eat (American Banker) see also Too Big to Fail banks still extend, pretend (Columbia Journalism Review)

• PolitiFact to launch PunditFact, checking pundits and media figures (Politifact)

• Why Republicans are losing the shutdown blame game (The Fix) see also GOP plummets, Obamacare soars in shutdown standoff (msnbc)

• Oceans of Life photography competition 2013 – in pictures (The Guardian)

What are you reading?

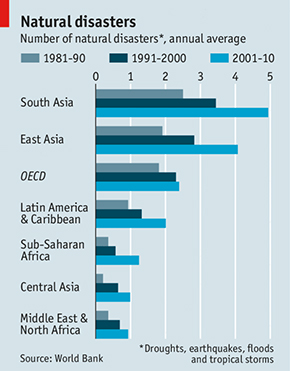

Natural disasters

Source: Economist

What's been said:

Discussions found on the web: