Good Wednesday morning; here is the shizzle:

• Stock Market Bubble vs. Impressive Bullish Breakout (Ciovacco Capital) see also Stocks breaking the all-time high barrier (USA Today)

• Investors seem genetically programmed to chase performance (WSJ)

• DC Follies, perhaps? Euro surges to highest level against dollar in nearly two years (WSJ)

• The downsides of quantitative easing, Cardiff Garcia watch (FT Alphaville) see also Weak Jobs Report Blurs Fed’s Policy Path (WSJ)

• More information might not improve your ability to make decisions (Farnam Street)

• How the Internet Is Changing What Economists Do (Fiscal Times) but see Maybe Economics Is A Science, But Many Economists Are Not Scientists (Krugman)

• Norris: Federal Employment at 47-Year Low (Economix)

• The Media Can’t Stop Sucking Up to Alan Greenspan (New Republic)

• WaPo GOP edition:

…..-Gay rights supporters wage a quiet campaign to push Republicans to the middle (Washington Post)

…..-GOP Senator Mitch McConnell is right. But will Republicans listen to him? (Washington Post)

• Apple Targets Microsoft Office With Free Apps (NY Times) see also Why Microsoft Word must Die – Charlie’s Diary (Antipope)

What are you reading?

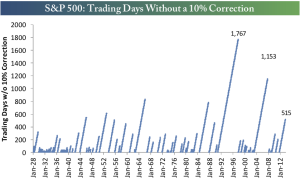

Source: Bespoke

What's been said:

Discussions found on the web: