My afternoon train reading:

• Yellen as Americans’ Favorite Shows Fed Is Captured by Democracy (Bloomberg)

• World likely to have 11 trillionaires within two generations: Credit Suisse (MarketWatch)

• Debt-Limit Disaster Is Exponentially Worse Than 2008 Lehman Debacle (Daily Beast) but see Everyone’s Talking About This Sneaky Solution To The Debt Ceiling That Might Be Even Better Than The Platinum Coin (Business Insider)

• Rallies End When “Good News” is Sold (The Reformed Broker)

• The great diversification bait and switch (FT Alphaville)

• US budget: Sequestration nation (FT.com) see also Recession Looms If Treasury Uses Tools to Prevent a Default (Bloomberg)

• US Shadow Inventory Reaches Five-Year Low (World Property Channel)

• Special Report: U.S. builders hoard mineral rights under new homes (Reuters)

• The New Science of Who Sits Where at Work (WSJ)

• Piracy Isn’t Killing The Entertainment Industry, Scholars Show (Torrent Freak)

What are you reading?

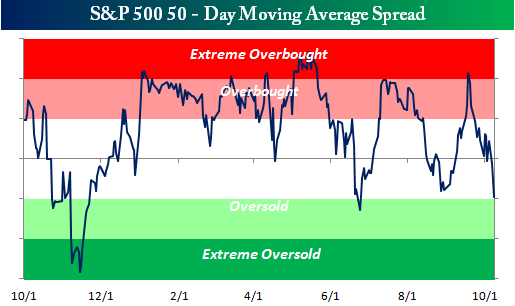

S&P 500 Hits Most Oversold Level Since June

Source: Bespoke

What's been said:

Discussions found on the web: