My good Columbus Day, congrats to Bob Shiller, Monday morning reading:

• Forty Years After OPEC Embargo, U.S. Is Energy Giant (Bloomberg)

• Art market: Painting by numbers (FT.com)

• This is the danger of default: U.S. fiscal failure warrants a de-Americanized world (Xinhua) see also Why China may not be over-investing (FT Alphaville)

• How important is an adviser’s track record? (MarketWatch)

• Todays WTF headline: David Stockman: Soak the Rich (Barron’s)

• The 13 reasons Washington is failing (Wonkblog) see also World Keeps Full Faith in U.S. Treasuries If Not Politics (Bloomberg)

• Why You’re So Bad With Your Money (Motley Fool) see also How Aging Impacts Our Financial Decisions (Forbes)

• My weekend with the iPhone 5s: It’s hard not to recommend this phone to anyone (Gigaom)

• Scott Adams’ Secret of Success: Failure (WSJ)

• Review: Paul McCartney sounds revitalized in ‘New’ (Pop & Hiss)

What are you reading?

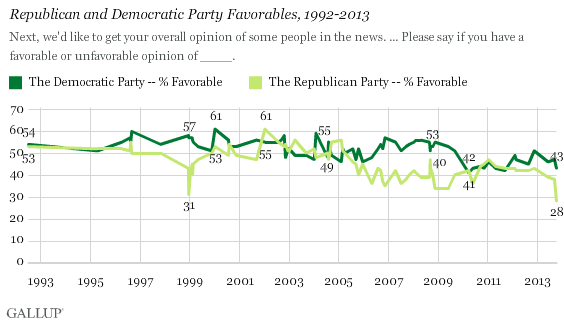

Republican Party Favorability Sinks to Record Low

Source: Gallup

What's been said:

Discussions found on the web: