My early morning reads:

• Regrets? The Maestro Has None (Barron’s) see also Wall Street’s Fed fixation (LA Times)

• What to Do with Small Caps? (Mebane Faber)

• I know that we the New Slaves (Reformed Broker) see also Slaves of the Internet, Unite! (NY Times)

• Munis Make the Shopping List (Barron’s)

• Wal-Mart Now Draws More Solar Power Than 38 U.S. States (Bloomberg) see also Mystery of the ‘Missing’ Global Warming (Bloomberg)

• Pros and Conflicts: Whose Side Is Your Broker On? (WSJ)

• Disruptions: Are Eager Investors Overvaluing Tech Start-Ups? (NY Times) see also Twitter’s white lie to investors: We’re profitable (Quartz)

• Marty Sullivan figured out how the world’s biggest companies avoided billions in taxes. Here’s how he wants to stop them. (Washington Post)

• Outsider Whose Dark, Lyrical Vision Helped Shape Rock ’n’ Roll (NY Times) see also Lou Reed, Velvet Underground Leader and Rock Pioneer, Dead at 71 (Rolling Stone)

• 18 Striking Images from Space Show Earth’s Rich Tapestry (Twisted Sifter)

What are you reading?

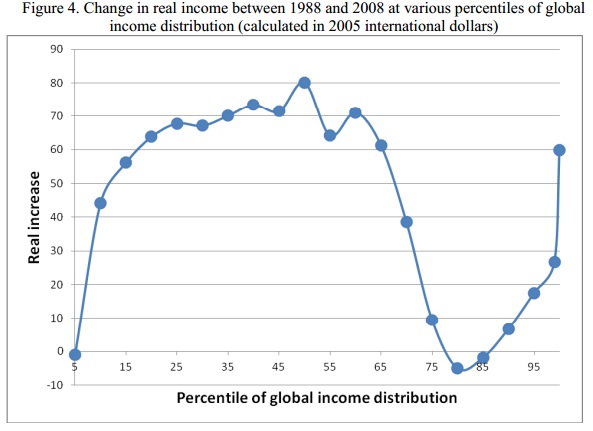

Change in Income Distribution, 1988 – 2008

Source: FT Alphaville

What's been said:

Discussions found on the web: