My afternoon reading:

• The 106 Finance People You Have To Follow On Twitter (Business Insider)

• How to Look Under a Hedge Fund’s Hood (WSJ)

• 3 ways Twitter’s IPO won’t be like Facebook’s (Fortune)

• The Business End of Obamacare (The New Yorker)

• CNBC Has Lowest-Rated Quarter in 20 Years (MediaIte)

• A Lonely Housing Bear Predicts a Big Tumble (Bloomberg)

• Delayed payments in 1979 offer glimpse of default consequences (Washington Post) see also When elections used to have consequences (First Read)

• Exploding Fuel Tankers Driving U.S. Army to Solar Power (Bloomberg)

• Climate change sceptics more likely to be conspiracy theorists (The Raw Story)

• Jeff Bezos Had His Top Execs Read These Three Books (Farnam Street)

What are you reading?

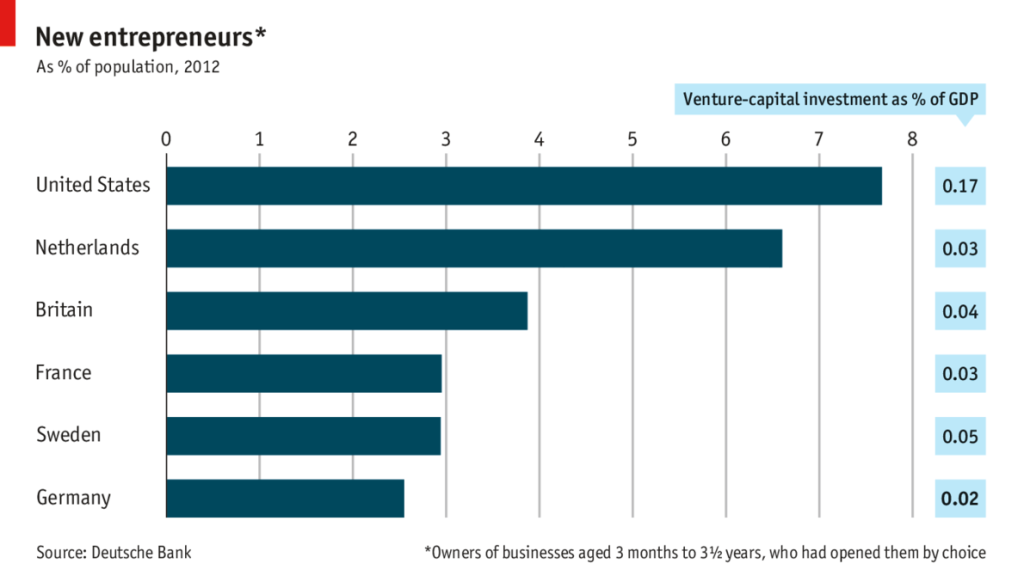

Entrepreneurship differs wildly among countries

Source: Economist

What's been said:

Discussions found on the web: