My Sunday reading:

• JPMorgan’s Record $13 Billion U.S. Settlement (Bloomberg) see also A Tentative Settlement Neither Side Can Be Happy About (MoneyBeat)

• Investing Like You Have Brain Damage (Motley Fool)

• Robert Shiller Interviews:

…..-A Nobel by acknowledging economic absurdity (Washington Post)

…..-A Skeptic and a Nobel Winner (NYT)

• Alan Greenspan still thinks he’s right (Washington Post)

• How to Pay Millions and Lag Behind the Market NYT see also Is Hedge-Fund Advertising Good or Bad for Investors? (WSJ)

• The investment manager ridiculed in “The Big Short” is now under fire from the SEC (Quartz)

• Benjamin Wittes: “Congress is the clearest & most present danger in world to national security of United States.” (NYT)

• Verizon Could Have Sold More iPhones in the Third Quarter (All Things D) see also Facebook ad profit a staggering 1,790% more on iPhone than Android (Venture Beat)

• Does the global warming ‘pause’ mean what you think it means? (The Guardian)

• Our Interview with Bill Watterson! (Mental Floss)

What are you reading?

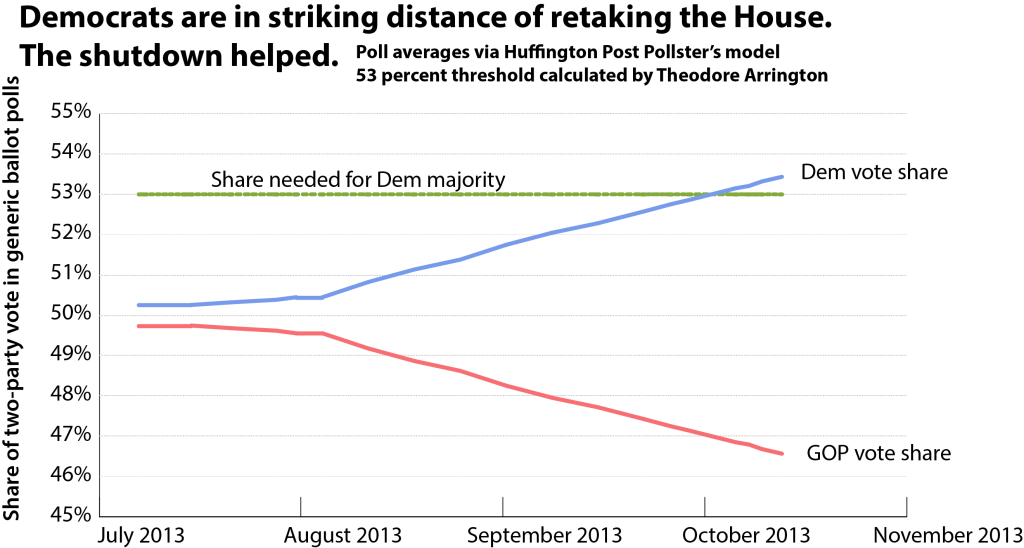

Tea Party Shut Down Might Cost GOP the House

Source: Washington Post

What's been said:

Discussions found on the web: