My afternoon train reading:

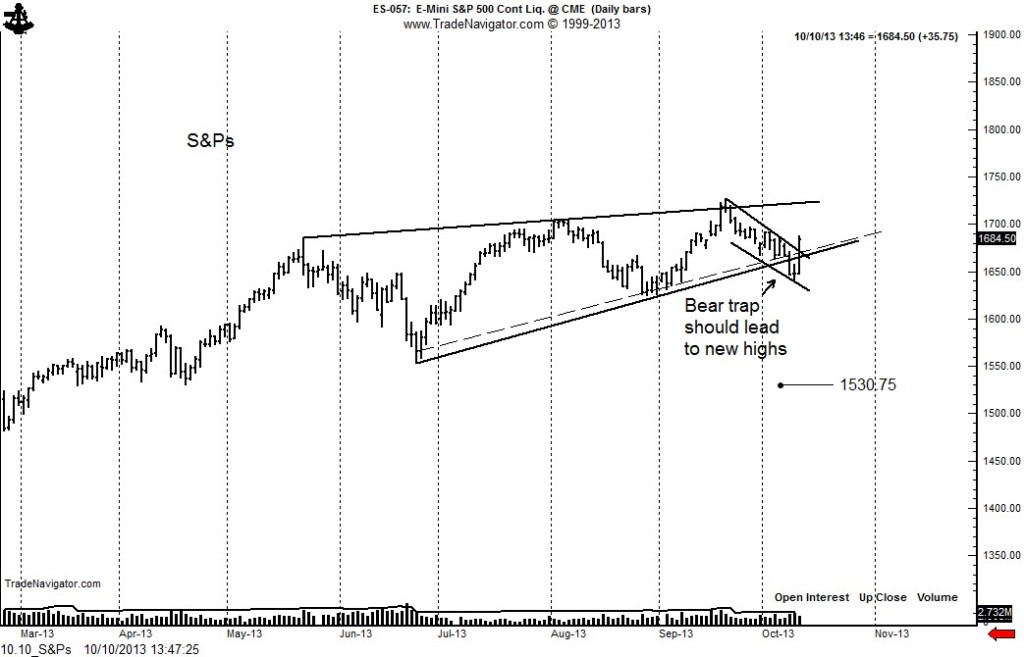

• Why It’s So Tough to Short This Market (Moneybeat) see also Bear trap in S&Ps and Dow should lead to new all-time highs (Brandt)

• At Risk: The Dollar’s Privilege as a Reserve Currency (NYT)

• Handicapping the 2013 Economics Nobel (Real Time Economics)

• “We are watching a train wreck in slow motion, but eventually there won’t be a crash” (MoneyBeat)

• Janet Yellen Big User Of Vanguard Funds (Index Universe) see also How to Get Your 401(k) Ready for Retirement (WSJ)

• 20 Simple Questions About The Federal Reserve (Slate)

• Why U.S. Health Care Is Obscenely Expensive, In 12 Charts (Huff Po)

• GOP moderates in tough spot in swing districts (MSN Money) see also Inside the Republican Suicide Machine (Rolling Stone)

• What Twitter knows that Blackberry didn’t (MarketWatch)

• The Best Things Kanye West Said to Jimmy Kimmel Last Night (Vulture)

What are you reading?

Bear trap in S&Ps, Dow should lead to new all-time highs

Source: Brandt

What's been said:

Discussions found on the web: