My morning reading:

• John Bogle Misses the Boat on Rebalancing (Servo Wealth Management)

• A Dozen Things I’ve Learned from Bill Ruane about Investing (25iq)

• Nobel Prize Shows Both Wisdom and Madness of Crowds (Bloomberg) see also Why do we *still* have a Nobel Prize in economics? (Crooked Timber)

• Absolutely everything you need to know about the debt ceiling (Wonkblog)

• The Fallacy of Success (Kottke)

• Is Unprecedented Inequality the Reason the Economy Can’t Recover? (The Reformed Broker) see also After the Jobs Disappear (NYT)

• Yergin: Why OPEC No Longer Calls the Shots (WSJ)

• For Many Hard-Liners, Debt Default Is the Goal (Economix) see also How safe is your money if the US defaults? (CNBC)

• The science interview: Jared Diamond (FT.com)

• How to Opt Out of Google Using Your Name and Face in Ads (Lifehacker)

What are you reading?

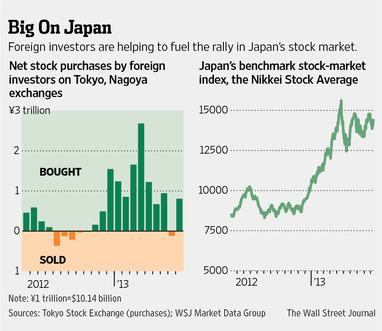

Japanese Stocks Lure More Long-Term Investors

Source: WSJ

What's been said:

Discussions found on the web: