My morning reading material:

• Physicists and the financial markets (FT)

• Whereforth Art Thou Alpha? Beating the Market has Become Nearly Impossible (Institutional Investor) see also You’ll never be a Yale superman (FT Alphaville)

• Justice Dept. sees $13 billion JPMorgan deal as a template for future bank settlements (Washington Post)

• Lord Skidelsky: Misconceiving British Austerity (Project Syndicate)

• Silicon Valley’s Secessionist Movement Is Growing (NY Mag)

• Experian Sold Consumer Data to ID Theft Service (Krebs on Security)

• How long will Google keep burning money on Motorola? (The Verge)

• The shale-gas boom won’t do much for climate change. But it will make us a bit richer. (Washington Post)

• Apple Two-fer:

…..-Apple Preparing 65-Inch TV for Release in 2014, Analyst Says (Bloomberg)

…..-Apple to Refresh IPads Amid Challenges for Tablet Share (Bloomberg)

• Startup to sell balloon trips to edge of space (WSJ)

What are you reading?

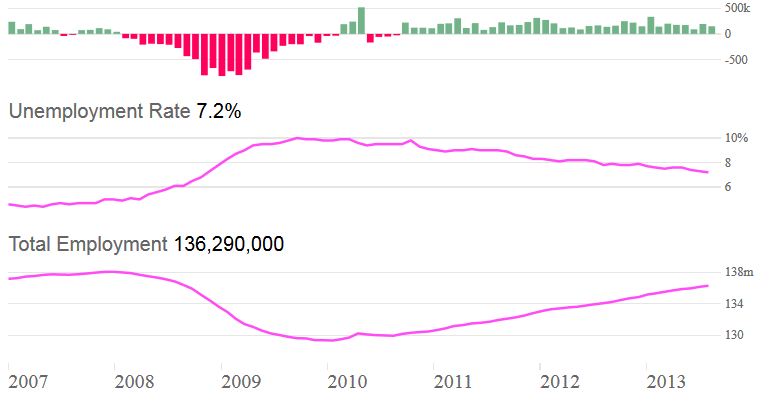

September Non Farm Payrolls

Source: Quartz

What's been said:

Discussions found on the web: