My morning reading:

• The Inefficiency of the Market Isn’t An Open Question (Rational Irrationality) see also Beating the Market: Yes, it can be done (Economist)

• What the Heck Is Smart Beta Anyway? (Morningstar)

• Singapore Shows Asia How To Crack Down on Housing Bubble (Bloomberg) see also China Intervened Aggressively in Currency Markets in Latest Quarter (WSJ)

• Imagining the Dollar Without Its Privilege (NYT)

• Bidding wars for houses begin to fade (Housing Wire)

• 2% of China’s public consumes one-third of world’s luxury goods (Want China Times)

• Malcolm Gladwell’s real problem (USA Today)

• China Presses U.S. Lawmakers to Lift Debt Limit (Bloomberg) see also House Republicans Show Themselves To Be Dangerously Incompetent, Again (Business Insider)

• Why Apple Hired Burberry CEO as SVP of Retail (stratēchery)

• 10 Unique Ocean Landscapes (The World Geography)

What are you reading?

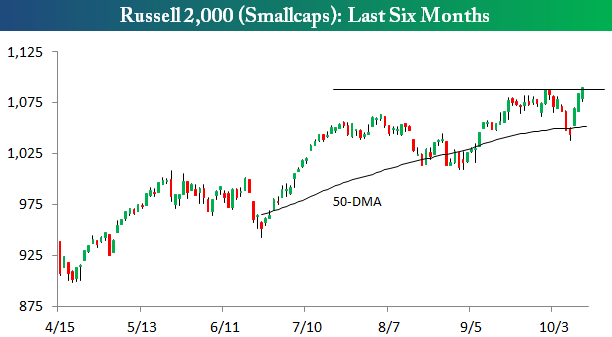

Smallcaps Hit New All-Time Highs

Source: Bespoke

What's been said:

Discussions found on the web: