click for larger graphic

Source: Political Calculations

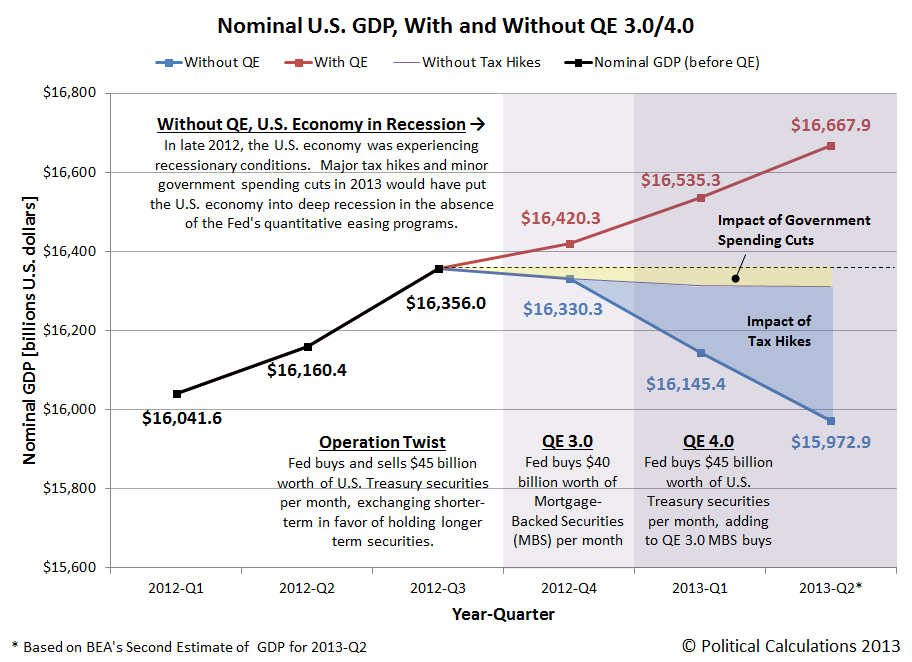

Earlier this morning, I suggested that when we consider the results of QE on NFP, we also consider what the world might look like in its absence. (Long term readers might recall I suggested we do the same thing with the bailouts as well, with the results being deeper selloff, more early pain, but a stronger and healthier recovery).

As it turns out, Political Calculations already did imagine what that might look like last month — the results being the chart above:

“The difference between the nominal GDP that was and the counterfactual of the nominal GDP that otherwise would have been is all due to the Fed’s quantitative easing programs, as measured by the cumulative change in total assets held by the Federal Reserve since the end of 2012-Q3. How we measured the relative impact of government spending cuts and tax hikes is explained here and their applicability is explained here.”

If QE never came into existence, the world might look different in a variety of ways:

1) Rates would be higher;

2) Home sales would likely be at both lower prices and lower volumes;

3) Auto Sales would either be weaker or skewed towards less expensive cars (or both);

My assumptions that follow this is that without QE:

1) employment would be softer, perhaps considerably so;

2) The normal clearing process for Housing would be occurring;

3) The economy would be significantly worse;

4) There would be an increasing number of foreclosures;

5) The TBTF bailed out banks would once again be in trouble;

The last assumption is that as things got appreciably worse, Congress would be forced to act with a major stimulus. I fthey failed to do so, there might be a signifciant change November 2014.

There is some irony in that the people who hate the Fed the most are potentially the biggest beneficiaries of their policies . . .

What's been said:

Discussions found on the web: