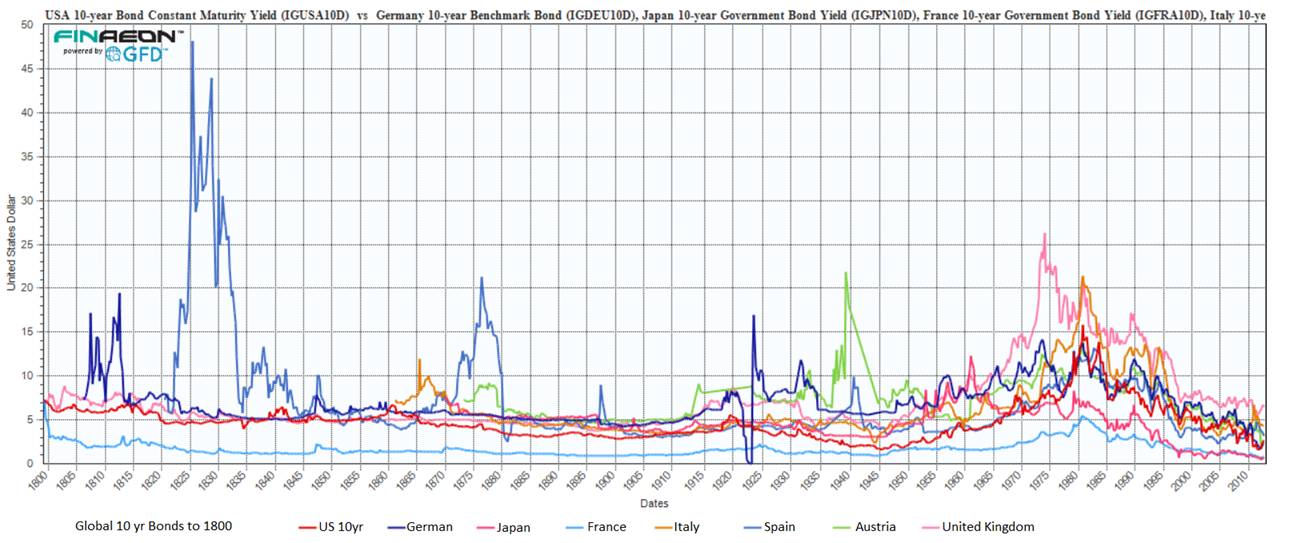

Yields and default

Click to enlarge

Now that we managed to avoid default, let’s look at some historical examples of Sovereign default.

1.

United States 2013

2. Germany 1938,1948

3. Japan 1942, 1946-1952

4. France 8 times between 1558-1788. Last one in 1812

5. Italy 1940. Almost daily speculation of another default since 2008

6. Spain 1809, 1820, 1931, 1834, 1851, 1867, 1872, 1882 and 1936-1939. Since 2008, Spanish yields spiked considerably and have been volatile on the back of another default

7. Austria 1938, 1940, 1945

8. United Kingdom 1822, 1834, 1888, 1932

While default is nothing new for many countries, this would have been for the United States.

Many economists have said that a US default would have catastrophic consequences for the global community. Borrowing costs would essentially sky rocket, global equity prices would be leveled, dollars status as a benchmark questioned and most importantly, a reversal into another deeper and darker world recession.

Glad we avoided that mess.

Source:

Ralph Dillon

Global Financial Data

What's been said:

Discussions found on the web: