I have been meaning to get to this since I was in Toronto last week, where I saw my friend (and fishing partner) Martin Barnes of BCA give an excellent presentation at the Toronto CFA Prediction Dinner.

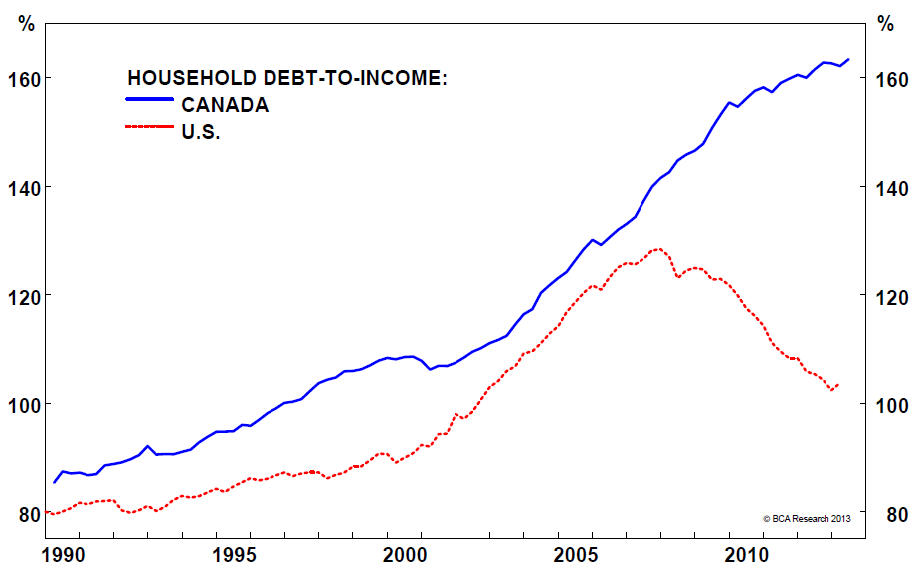

One of that charts that really stood out to me was the one above. You cans ee how as the housing boom deflated the debt to income ratio fell 30% or so in the US. But in Canada, there was no such day of reckoning, and that ratio diverged from the USA’s and is now above 160%.

There are many reasons why Canada’s boom did not bust — their laws require mortgage insurance, minimum down payments and actual credit checks; they have a well regulated banking system less given towards spams of insanity. Economically, energy and minerals are still hot; and there are enormous numbers of Chinese buying up condos in Vancouver and Toronto and elsewhere as a way to get cash out of the country and create an emergency life raft in case China implodes.

Regardless of these and many other differences between our two nations, this chart does give one pause . . . .

What's been said:

Discussions found on the web: