Click to enlarge

Source: Economist

According to the Economist:

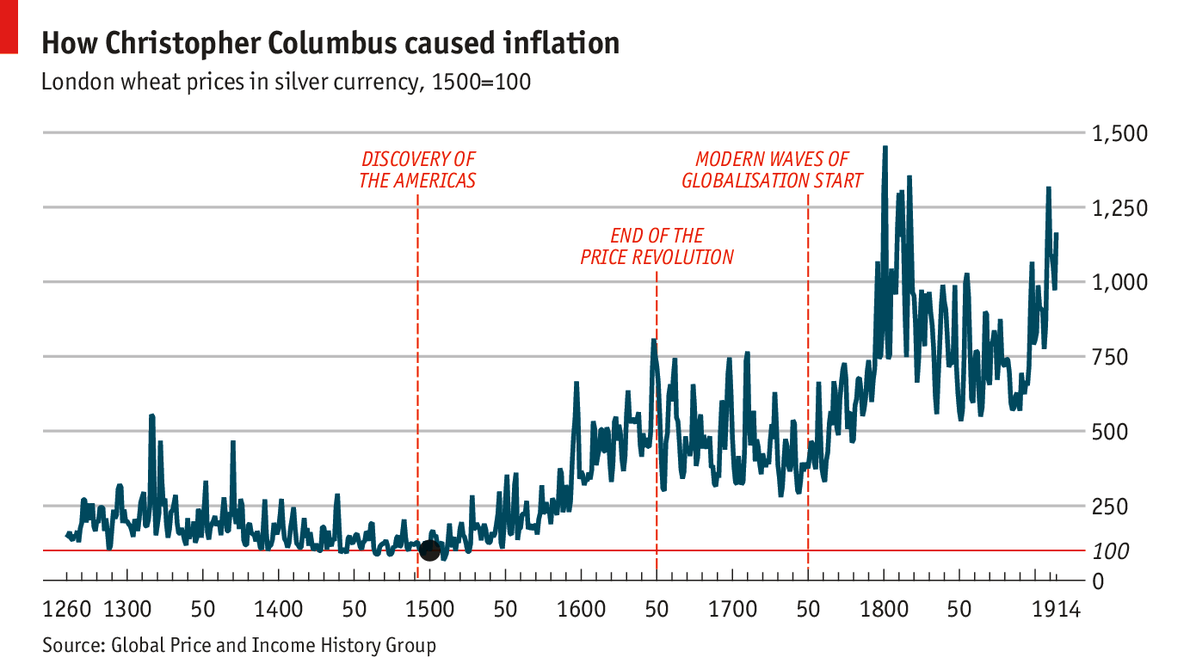

“Some modern economic historians dispute Smith’s argument that the discovery of the Americas, by Christopher Columbus in 1492, accelerated the process of globalisation. Kevin O’Rourke and Jeffrey Williamson argued in a 2002 paper that globalisation only really began in the nineteenth century when a sudden drop in transport costs allowed the prices of commodities in Europe and Asia to converge. Columbus’ discovery of America and Vasco Da Gama’s discovery of the route to Asia around the Cape of Good Hope had very little impact on commodity prices, they argue.

But there is one important market that Mssrs O’Rourke and Williamson ignore in their analysis: that for silver. As European currencies were generally based on the value of silver, any change in its value would have had big effects on the European price level. Smith himself argued this was one of the greatest economic changes that resulted from the discovery of the Americas:

The discovery of the abundant mines of America, reduced, in the sixteenth century, the value of gold and silver in Europe to about a third of what it had been before. As it cost less labour to bring those metals from the mine to the market, so, when they were brought thither, they could purchase or command less labour; and this revolution in their value, though perhaps the greatest, is by no means the only one of which history gives some account.

The influx of about 150,000 tonnes of silver from Mexico and Bolivia by the Spanish and Portuguese Empires after 1500 reversed the downwards price trends of the medieval period. Instead, prices rose dramatically in Europe by a factor of six or seven times over the next 150 years as more silver chased the same amount of goods in Europe.

There you have it. Columbus ended price deflation by discovering lands rich in Silver.

What's been said:

Discussions found on the web: