click for ginormous charts

Source: JP Morgan

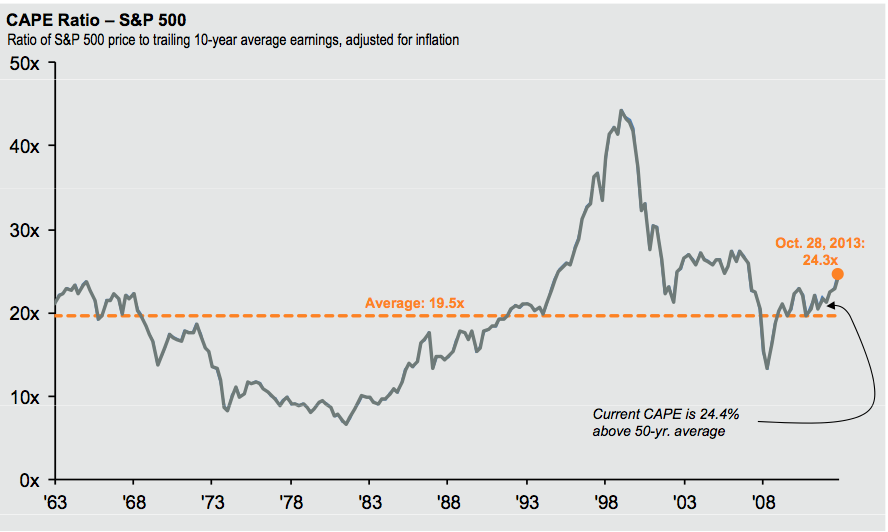

JP Morgan observes: “Shiller P/E shows the market to be overvalued, but not as extreme if you use the NIPA data.”

I’ve never used the NIPA data, so I have no real opinion on it. The two charts look directionally similar, but different in terms of magnitude.

For those of you bulls in search of some valuation confirmation bias, NIPA is your best bet.

Thoughts?

Source:

Washington Reset: Investing in the Wake of the Shutdown

Dr. David Kelly Chief Global Strategist

J.P. Morgan Funds October 30, 2013

What's been said:

Discussions found on the web: