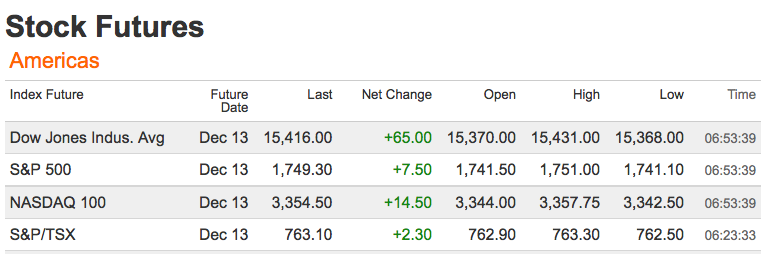

click for updated futures

Source: Bloomberg

Yesterday morning I wrote Look Out Below, I Don’t Know Why Edition. Today, the market half is a mirror image — up about as much as yesterday was down. The only thing that remains the same is my ignorance — I really don’t know why markets are up today or down yesterday.

One headline notes that “U.S. Stock Futures Rise Amid Earnings, China Factory Data” — but we had mixed earnings yesterday, and so far, earnings are mixed today. And Chinese economic data was good yesterday. This leads to my regularly offering up my insight with a big fat I don’t know.

All too often, investors try to construct a plausible explanation, typically in narrative form, as to what is going on. The danger is not so much that they fail — that to be expected — but rather that they confuse their confabulated narrative for truth, and mistakenly believe their own bullshit for reality.

This leads to a combination of ill informed decisions making which cannot help but produce poor judgements.

Rather than focus on what is unknown, and perhaps unknowable, I would counsel investors to focus on techniques that eliminate the noise to focus on signal. Eliminating known errors is a good start, as is reducing the consumption of frivolous, consistently wrong, or merely useless junk.

How can you get more signal, and less noise in your day? There are ways to accomplish this, which I hope to detail tomorrow . . .

What's been said:

Discussions found on the web: