A short note as I am running late this AM.

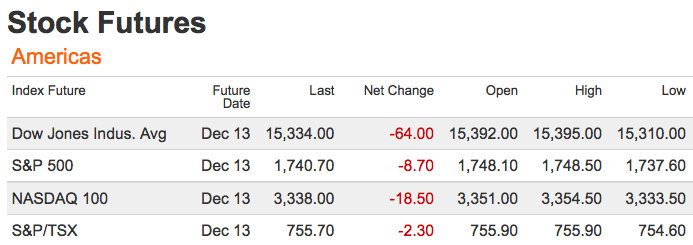

Markets are looking soft, and for more or less for no good reason. Perhaps its because they have been on a tear lately, and need to digest gains. Or maybe its for some completely other reason.

As I noted in the headline, I don’t know.

Investors would be better off if they stop trying to find a rational ause and effect for what oftentimes is an unpredictable action in market prices — “random walk” in the parlance of this year’s Nobel winner.

That phrase “I don’t know” is another that should ente rmore investor’s lexicon as well.

Be back shortly…

What's been said:

Discussions found on the web: