My afternoon train reading:

• Bear Hunting (FT Alphaville) see also Where are the global growth optimists? (FT Alphaville)

• Stock Tribes (Reformed Broker)

• Funds of hedge funds recast dismal model (FT) see also Being Wrong Works at Scale…Hedge Funds and Bank of America (Howard Lindzon)

• Which CEO Will Be Next to Talk Down His Own Stock? (Yahoo)

• Fed Balance Sheet Not Seen Returning to Normal Until at Least 2019 (WSJ) but see Hilsenrath: December Taper Not Off the Table (WSJ)

• The App Store Era’s Biggest Winners And Losers (Splat F)

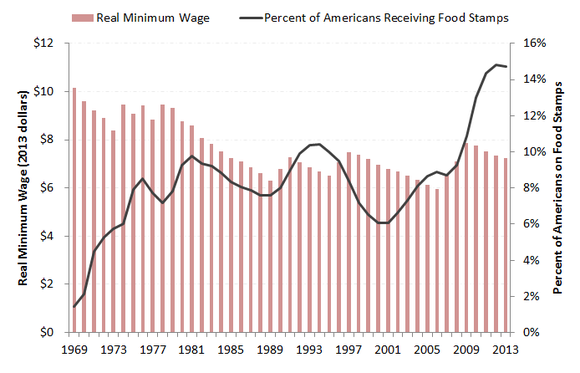

• How You Subsidize the Minimum Wage (Motley Fool)

• A New View of the Corporate Income Tax (Economix)

• Out of this world: Britain’s ‘top scientist’ Martin Rees says our brains may not yet have evolved sufficiently to unlock the secrets of the cosmos (FT)

• Orson Welles’ War of the Worlds Did Not Touch Off a Nationwide Hysteria. Few Americans Listened. Even Fewer Panicked. (Slate)

Whats up with that?

Why Are Taxpayers Subsidizing Wealthy Companies?

Source: Motley Fool

What's been said:

Discussions found on the web: