click for ginormous chart

Source: Standard & Poor’s, First Call, Compustat, FactSet, J.P. Morgan

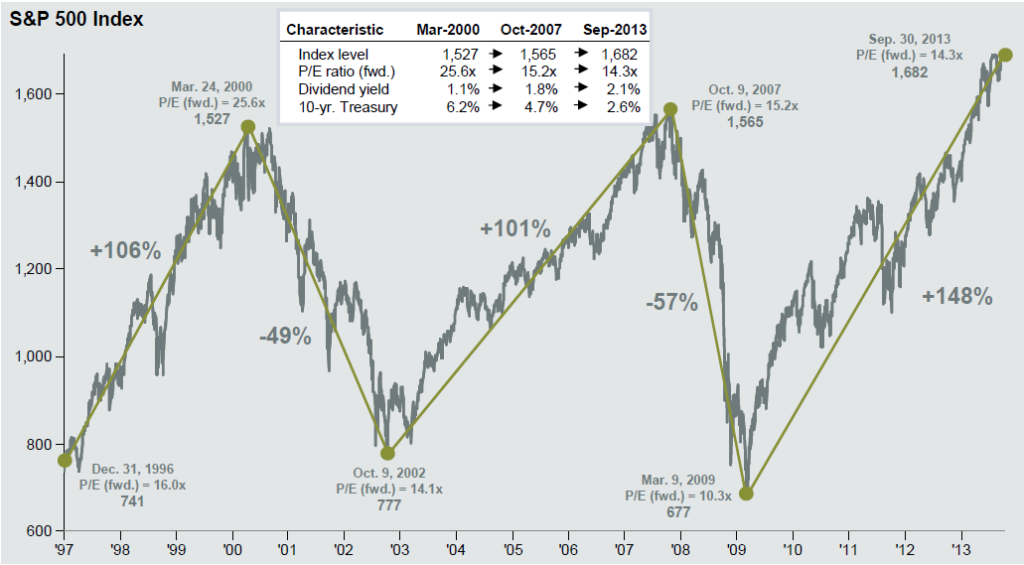

Its time for the update of one of our favorite massive charts, via the quarterly Market Insights JPM puts out. (Yeah, I criticize Dimon but that doesn’t mean he doesn’t have some insightful people working for him).

As you can see, we are about 3 S&P points below where the quarter ended, despite all of the noise. This is why I suggest investors tuen out the short term, and focus on the longer term trends.

(You can download the full JPM Guide to Markets here).

What's been said:

Discussions found on the web: