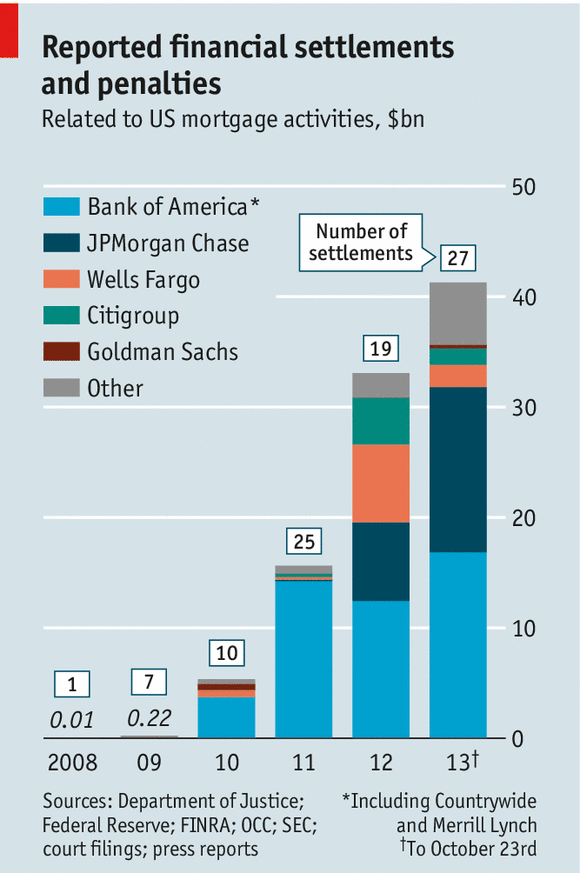

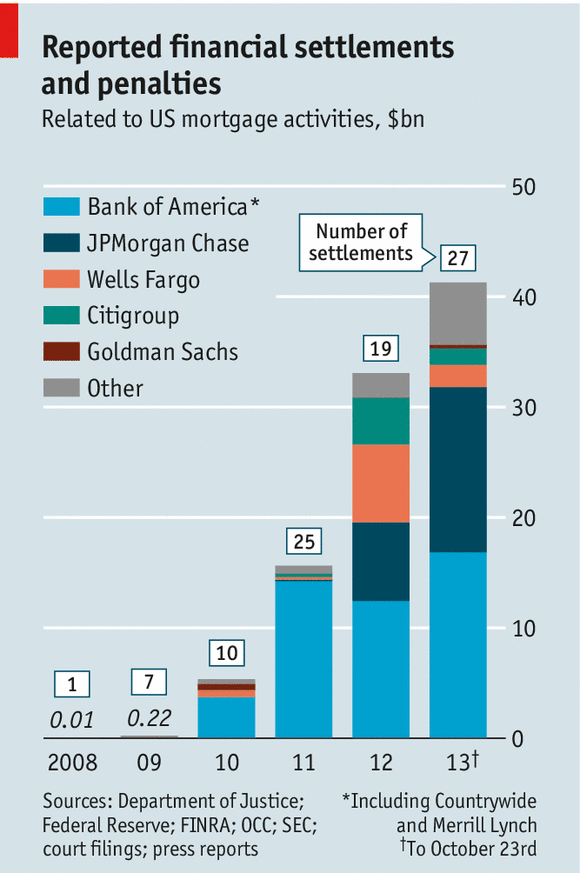

In less than 5 years, these 5 banks have amassed nearly $100 Billion dollars in fines n 81 settlements:

click for ginormous graphic

Source: Economist via Washington Post

In less than 5 years, these 5 banks have amassed nearly $100 Billion dollars in fines n 81 settlements:

click for ginormous graphic

Source: Economist via Washington Post

Get subscriber-only insights and news delivered by Barry every two weeks.

What's been said:

Discussions found on the web: