My longer form reads for the weekend:

• Dallas Fed’s Richard Fisher: Money Makes the World Go Round (Texas Monthly)

• The Pixar Theory (Jon Negroni)

• The Craft Beer Movement (Priceonomics)

• William Sharpe: The Arithmetic of Active Management (Stanford)

• NFL Free-Agent Lawyer to Unlock $16 Billion in NCAA Athletes (Bloomberg)

• How do religions die? (The Guardian)

• Fault Line Splits Hollywood – literally (WSJ)

• Chinese Philosophy Lifts Off in America (Chronicle)

• How a Purse Snatching Led to the Legal Justification for NSA Domestic Spying (Wired)

• A New Theory on “Mark Twain” by Daniel Hernandez (Los Angeles Review of Books) see also Book Review: ‘David and Goliath’ by Malcolm Gladwell (WSJ)

What are you doing this weekend?

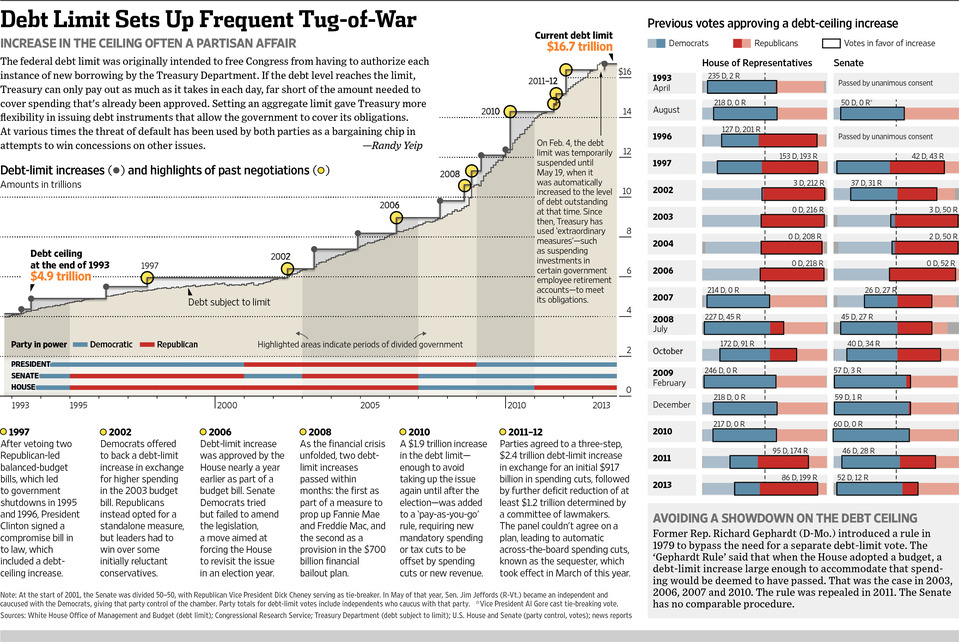

Markets Shrug at Shutdown Even as Debt Battle Looms

Source: WSJ

What's been said:

Discussions found on the web: