Every now and then, I read an article that is factually accurate, technically correct — and utterly misleading.

Items like this are “accurate but false” as they leave the reader with an impression of something that is incorrect. Because the world is nuanced and not black and white, the sum of many facts, statistics and data can (when skillfully blended) create a completely inaccurate impression.

The latest example of such is a perfectly accurate but utterly misleading article in All About Alpha titled AIMA Survey, Interviews: On Regulatory Costs.

“Hedge fund managers have sustained significant costs in the course of compliance with new regulatory requirements.

According to a new report by the Alternate Investment Management Association, the Managed Funds Association, and KPMG International, small fund managers have invested on average $700,000 in compliance, medium-sized fund managers $6 million, and large fund managers $14 million.

The industry as a whole has spent $3 billion on compliance costs. This is more than 7% of its total operating costs.”

Most people’s immediate emotional response is that $3 billion is a lot of money, and that 7% of its total operating costs is a very significant percentage.

A few obvious problems with the report:

1) That $3 billion in Regulatory Costs is out of more than $2 trillion dollars in assets under management. In other words, their compliance costs are about 1/10th of 1% of AUM. Given that managers get paid 2% plus 20% of profits, this is a teeny percentage.

2) The article fails to inform us if this total operating costs is going up or down relative to recent easing of regulatory requirementsm such as the JOBS act.

3) Finally, the report is based on a survey of 200 hedge fund managers from around the world — out of more than 10,000. Such a small statistical sample has a very large potential error rate.

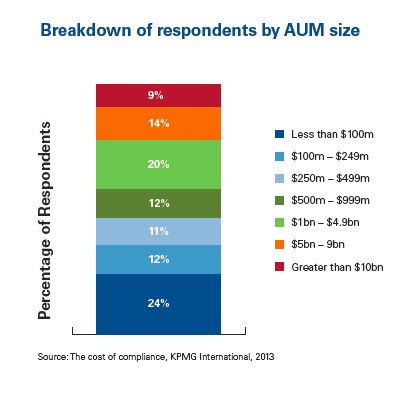

To be fair, the regulatory burdens will most likely fall disproportionately upon smaller funds. There are fixed costs inherent in all asset management / trading ventures, and they fall in proportion relative to increase in size. Indeed, the chart below showing the response to the survey — notwithstanding the self-selecting bias inherent thereto — shows the greatest response from smaller funds.

With this post, we introduce the category “Bad Math”.

Source:

AIMA Survey, Interviews: On Regulatory Costs

By cfaille

All About Alpha, Oct 27th, 2013

http://allaboutalpha.com/blog/2013/10/27/29819/

What's been said:

Discussions found on the web: