Recovery’s Great If You Were Already Rich (or Even Modestly Well Off)

The beneficiaries of the economic recovery have been a somewhat narrow group: Those who are highly educated and already are high earners are feeling the positive effects in both employment and wage gains

Bloomberg, November 12, 2013

The Labor market continues to improve. Last week Bureau of Labor Statistics reported 204,000 new positions created, and adjustments to prior months data were upward.

But the gains are not all they are cracked up to be. The jobs recovery has not been evenly distributed. The beneficiaries of the economic recovery have been a somewhat narrow group: Those who are highly educated and already are high earners are feeling the positive effects in both employment and wage gains. For the rest of the labor pool, it is not nearly so rosy a story.

Consider the difference in joblessness: Unemployment rates for those with a college degree is just 3.8 percent; its even lower for those with graduate degrees. Those workers who have less than high-school diplomas? Their unemployment rate is 10.9 percent.

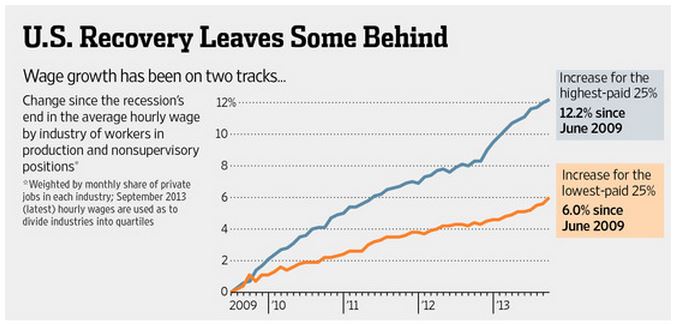

Wage differences are also similarly stark. The top quartile has seen 12.2 percent increase in wages since the recession ended in 2009. The bottom quartile’s gains have been half that, at 6.0 percent. The gains are even greater for the top decile, with heavy concentrations of wage increases in the top 1 percent.

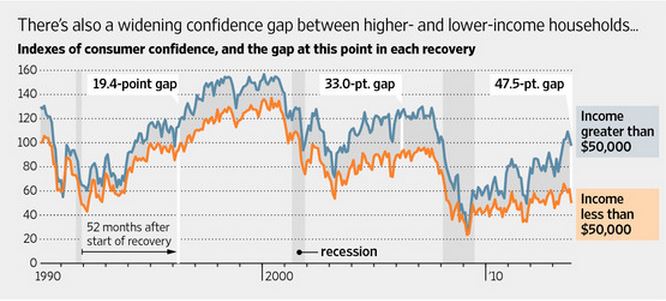

As the Wall Street Journal noted, this is why the “four-year-old upturn still doesn’t feel like one to many Americans.” As high earners are spending their disposable incomes on luxury goods, much of the rest of the economy feels stuck in neutral.

As Bloomberg View showed in an interactive graphic on Friday, many well-paying middle-class jobs have disappeared. Manufacturing and construction and two sectors that have done rather poorly in this recovery.

There are lots of other examples of this bifurcation. Young versus old, high-education versus low-education, highly skilled vs. unskilled.

Perhaps the biggest split surprise is in confidence levels. As the chart above shows, there is a split just about at the level of median household income in the US (~$51,000). Those whose families are earning above that line are feeling more comfortable with the slowly improving economy, improving wages and job security. Those below the median income levels say they have far less confidence in the economy. There is a huge 47.5 point gap between the two.

Usually by this point in the recovery, the economic gains are less lumpy and more evenly distributed. Whether it’s a function of this being a post-credit-crisis era, or a somewhat artificially manufactured economy, it points out a weakness in the current employment situation.

It could be worse — we could be suffering from Europe’s elevated unemployment levels — well over 10 percent in many countries.

Originally Recovery’s Great If You Were Already Rich (or Even Modestly Well Off)

What's been said:

Discussions found on the web: