Happy holidays! Here are some things to read while the kiddies unwrap their loot:

• On Wall Street things rarely turn out quite the way you expect, and 2013 was no exception. (WSJ)

• Gold’s Real Problem: Deflation (Barron’s) see also Hedge Funds Cut Gold Bull Bets Amid Record Outflows (Bloomberg)

• How Real Income Stacks Up Around the World (MoneyBeat)

• Fixing the Shiller CAPE: Accounting, Dividends, and the Permanently High Plateau (Philosophical Economics)

• Is the ‘Permanent Portfolio’ Permanently Broken? (The Street)

• Foreclosures Drop to Eight-Year Low as Crisis Wanes (Bloomberg)

• Robots and Economic Luddites: They Aren’t Taking Our Jobs Quickly Enough (Beat the Press)

• The Budget Deficit as Seen From 2009 (Economix)

• Pethokoukis’ Christmas Wish: A Less Debt-Obsessed GOP (National Review)

• 55 Brilliant Louis C.K. Quotes That Will Make You Laugh And Think (Thought Catalog)

What are you reading?

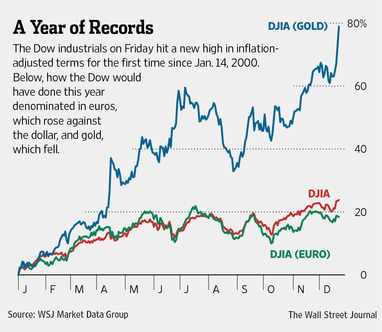

I hate charts like this: DJIA Priced in Gold

Source: WSJ

What's been said:

Discussions found on the web: